Kicking off with What are altcoins in cryptocurrency?, this opening paragraph is designed to captivate and engage the readers, setting the tone for a deep dive into the realm of alternative digital currencies beyond Bitcoin. From popular altcoins to the process of creating them, this article aims to provide a comprehensive understanding of this dynamic sector in the cryptocurrency market.

What are Altcoins?: What Are Altcoins In Cryptocurrency?

Altcoins, short for alternative coins, refer to any cryptocurrency other than Bitcoin. These digital currencies operate on their own blockchain networks and offer various features and functionalities.

When it comes to Ethereum 2.0, there are several top features that set it apart from its predecessor. From the introduction of staking to the implementation of shard chains, Ethereum 2.0 promises to revolutionize the blockchain industry. To learn more about the top features of Ethereum 2.0, check out this informative article: Top features of Ethereum 2.0.

Examples of Popular Altcoins

- Ethereum (ETH): Known for smart contract capabilities.

- Ripple (XRP): Primarily used for cross-border payments.

- Litecoin (LTC): Offers faster transaction speeds compared to Bitcoin.

- Cardano (ADA): Focuses on scalability and sustainability.

Differences between Altcoins and Bitcoins

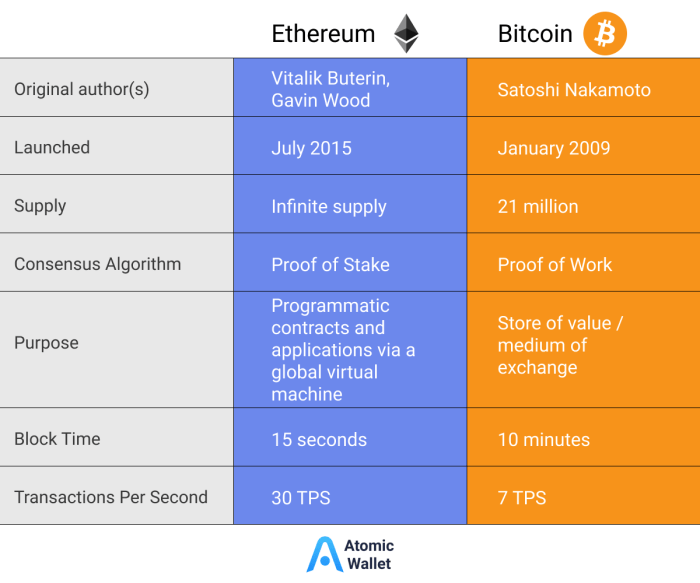

While Bitcoin is the first and most well-known cryptocurrency, altcoins have emerged to offer different use cases and functionalities. Some key differences between altcoins and Bitcoins include:

- Technology: Altcoins often utilize different underlying technologies and consensus mechanisms compared to Bitcoin.

- Market Adoption: Altcoins may have varying levels of adoption and acceptance in the market compared to Bitcoin.

- Features: Altcoins may offer unique features such as privacy enhancements, smart contracts, or faster transaction speeds that Bitcoin does not have.

Types of Altcoins

There are various types of altcoins available in the cryptocurrency market, each with its own unique characteristics and features. Let’s explore some of the most common types:

1. Stablecoins

Stablecoins are a type of cryptocurrency that is pegged to a stable asset, such as a fiat currency like the US Dollar. This helps to minimize price volatility and provides a more stable store of value compared to other cryptocurrencies.

2. Privacy Coins

Privacy coins focus on enhancing anonymity and privacy for users by implementing advanced cryptographic techniques. Examples of privacy coins include Monero (XMR) and Zcash (ZEC), which offer enhanced privacy features for transactions.

Ethereum 2.0 introduces several top features that are set to revolutionize the blockchain industry. From its proof-of-stake consensus mechanism to sharding for scalability, Ethereum 2.0 promises faster transactions and lower energy consumption. With the integration of these new features, Ethereum 2.0 is positioned to become a more efficient and sustainable blockchain platform for the future.

Learn more about the top features of Ethereum 2.0 and how they are reshaping the decentralized landscape.

3. Utility Tokens

Utility tokens are specific to a particular platform or service and are used to access or pay for services within that ecosystem. Examples include Binance Coin (BNB) for the Binance exchange and Ethereum’s Ether (ETH) for transactions on the Ethereum network.

4. Security Tokens, What are altcoins in cryptocurrency?

Security tokens represent ownership of assets or shares in a company and are subject to regulatory compliance. These tokens offer investors ownership rights and potential dividends, making them more akin to traditional securities.

5. Governance Tokens

Governance tokens give holders voting rights and decision-making power within a decentralized autonomous organization (DAO) or blockchain network. Token holders can participate in protocol upgrades, proposals, and other governance decisions.

Altcoin Development

Creating and launching an altcoin involves a series of steps and considerations that are crucial for the success and sustainability of the new cryptocurrency. Factors such as technology, market demand, community support, and regulatory compliance play a significant role in the development process.

Factors Influencing Altcoin Development

- Market Demand: The popularity and demand for a new altcoin can heavily influence its development. Developers often focus on creating a unique value proposition to attract investors and users.

- Technology: The underlying technology of an altcoin, such as its consensus mechanism and scalability, is a critical factor in its development. Innovations in blockchain technology can set new altcoins apart from existing ones.

- Community Support: Building a strong community around an altcoin is essential for its growth and adoption. Active community participation can drive awareness, development, and usage of the altcoin.

- Regulatory Compliance: Adhering to regulatory guidelines and compliance standards is crucial for the long-term success of an altcoin. Ensuring legal compliance can help build trust among investors and users.

Significance of Altcoin Development

Altcoin development plays a crucial role in diversifying the cryptocurrency ecosystem and fostering innovation within the industry. New altcoins introduce unique features, use cases, and technologies that can address specific market needs and drive overall growth in the market. Additionally, altcoin development encourages competition and collaboration among different projects, leading to advancements in blockchain technology and expanding the possibilities of decentralized finance.

Altcoin Market

The altcoin market has shown significant growth and evolution over the years, with various digital currencies emerging to compete with Bitcoin. Factors such as market demand, technological advancements, regulatory changes, and investor sentiment play a crucial role in shaping the value and trends of altcoins.

Market Trends for Altcoins

- Altcoin market capitalization has experienced fluctuations, with periods of rapid growth followed by corrections.

- New altcoins are regularly introduced, offering innovative features and use cases to attract investors.

- The dominance of Bitcoin in the cryptocurrency market has decreased over time, with altcoins gaining market share.

Factors Impacting Altcoin Value

- Market demand and supply dynamics influence the price of altcoins, with high demand leading to price appreciation.

- Technological developments and upgrades in altcoin networks can enhance their utility and value proposition.

- Regulatory developments and government interventions can impact investor confidence and affect the value of altcoins.

Challenges and Opportunities in Trading Altcoins

- Volatility in altcoin prices presents both opportunities for profit and risks for investors.

- Liquidity issues in certain altcoin markets can make trading challenging, impacting price stability.

- Diversification through altcoin investments can provide opportunities to capitalize on emerging trends and niche markets.

Last Word

In conclusion, altcoins offer a diverse and evolving landscape within the cryptocurrency market, providing unique opportunities and challenges for investors and enthusiasts alike. As the altcoin market continues to grow and innovate, staying informed and adaptable is key to navigating this exciting sector of the digital economy.