As How to set up a diversified stock portfolio takes center stage, this opening passage beckons readers with ahrefs author style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Diversifying your stock portfolio is a crucial step in building a robust investment strategy. By spreading your investments across different types of stocks, you can lower risk and potentially enhance your overall returns. In this guide, we will delve into the key aspects of setting up a diversified stock portfolio to help you make informed investment decisions.

Importance of Diversification in Stock Portfolio: How To Set Up A Diversified Stock Portfolio

Diversification is a crucial strategy when it comes to building a stock portfolio. By spreading your investments across different asset classes, industries, and geographical regions, you can reduce the risk of significant losses from any single investment.

Mitigating Risk through Diversification

- Diversification helps mitigate risk by spreading investments across various sectors. For example, if one sector experiences a downturn, other sectors may still perform well, balancing out potential losses.

- By investing in different asset classes such as stocks, bonds, and real estate, you can further reduce risk. Each asset class responds differently to market conditions, providing a buffer against volatility.

- Geographical diversification is also essential. Investing in companies from different regions can protect your portfolio from country-specific risks such as political instability or economic downturns.

Improving Portfolio Performance with Diversification, How to set up a diversified stock portfolio

- Diversification can improve overall portfolio performance by allowing you to capture gains from various sources. When one investment underperforms, others may outperform, leading to a more stable and consistent return on investment.

- By spreading investments across different industries, you can take advantage of growth opportunities in multiple sectors. This can help you benefit from trends and innovations that are driving specific industries forward.

- Reducing the correlation between assets in your portfolio through diversification can also enhance risk-adjusted returns. When assets are not closely correlated, the impact of a market downturn on your entire portfolio is minimized.

Types of Stocks to Include in a Diversified Portfolio

When setting up a diversified stock portfolio, it is essential to include different types of stocks to spread risk and maximize returns. Let’s explore the characteristics of growth stocks, value stocks, dividend stocks, as well as the role of index funds and ETFs in diversifying a stock portfolio.

Growth Stocks

- Growth stocks are shares in companies that are expected to grow at a rate significantly above average.

- These companies typically reinvest their earnings into expanding their business operations rather than paying dividends.

- Investors are attracted to growth stocks for their potential to deliver substantial capital gains over time.

- Examples of growth stocks include technology companies like Amazon and Google.

Value Stocks

- Value stocks are shares in companies that are considered undervalued by the market.

- These companies often have strong fundamentals but are trading at a lower price compared to their intrinsic value.

- Investors in value stocks aim to benefit from the price appreciation when the market recognizes the true worth of the company.

- Examples of value stocks include established companies in traditional industries like banking and utilities.

Dividend Stocks

- Dividend stocks are shares in companies that pay out a portion of their earnings to shareholders in the form of dividends.

- These companies are often stable and mature, generating consistent income for investors.

- Investors in dividend stocks seek regular income streams alongside potential capital appreciation.

- Examples of dividend stocks include large-cap companies like Coca-Cola and Johnson & Johnson.

Index Funds and ETFs

- Index funds and Exchange-Traded Funds (ETFs) are investment vehicles that hold a diversified basket of stocks.

- Index funds track a specific market index, such as the S&P 500, providing broad exposure to the overall market.

- ETFs can be sector-specific or thematic, offering investors a way to diversify across different industries or investment themes.

- Including index funds and ETFs in your portfolio can help reduce individual stock risk and provide broad market exposure.

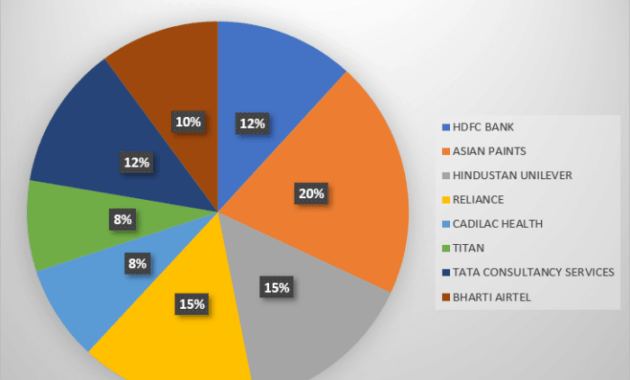

Setting Allocation Targets

Determining the percentage allocation for each stock in a diversified portfolio is a crucial step in achieving a balanced and effective investment strategy. Asset allocation plays a significant role in managing risk and maximizing returns based on an investor’s risk tolerance and investment goals.

Concept of Asset Allocation

Asset allocation involves dividing an investment portfolio among different asset classes, such as stocks, bonds, and cash equivalents, to achieve a desired risk-return profile. The allocation strategy is typically based on factors like age, financial goals, time horizon, and risk tolerance. For example, a younger investor with a higher risk tolerance may allocate a larger percentage of their portfolio to stocks for growth potential.

Examples of Allocation Strategies

- Equal Weighting: Allocating an equal percentage of funds to each stock in the portfolio. This strategy ensures a balanced approach but may not consider the individual characteristics of each stock.

- Market Capitalization Weighting: Allocating funds based on the market capitalization of each stock. Larger companies receive a higher percentage of the allocation, reflecting their market dominance.

- Risk-Based Allocation: Allocating more funds to lower-risk stocks and less to higher-risk stocks based on volatility and other risk metrics. This strategy aims to reduce overall portfolio risk.

Rebalancing and Monitoring the Portfolio

Regularly rebalancing a diversified stock portfolio is crucial to maintain the desired asset allocation and risk levels. Over time, market fluctuations can cause the weights of different assets to drift from their original targets, potentially exposing the portfolio to higher risk than intended. Rebalancing helps to realign the portfolio with the investor’s goals and risk tolerance.

Importance of Rebalancing

- Prevents portfolio drift: Rebalancing ensures that the portfolio remains in line with the investor’s risk tolerance and investment objectives.

- Controls risk exposure: By rebalancing, investors can avoid overexposure to certain assets that have performed well recently, reducing the risk of significant losses in case of a market downturn.

- Locks in gains: Rebalancing allows investors to sell high-performing assets and buy underperforming ones, potentially capturing profits and positioning the portfolio for future growth.

Indicators for Rebalancing

- Deviation from target allocation: If certain assets deviate significantly from their target weights, it may be time to rebalance the portfolio to restore the original allocation.

- Market conditions: Changes in market conditions or economic outlook may warrant a reassessment of the portfolio and potential rebalancing to adapt to the new environment.

Monitoring Tools and Methods

- Portfolio management software: Utilize tools like investment tracking software or online platforms that provide real-time updates on the performance of each stock in the portfolio.

- Regular reviews: Conduct periodic reviews of the portfolio to evaluate the performance of individual stocks and assess whether any adjustments are needed to maintain the desired asset allocation.

- Financial ratios: Monitor key financial ratios of individual stocks, such as price-to-earnings ratio, earnings per share, and dividend yield, to gauge their performance and make informed decisions on rebalancing.

Final Review

In conclusion, establishing a diversified stock portfolio is a smart way to manage risk and optimize your investment outcomes. By following the principles Artikeld in this guide, you can create a well-balanced portfolio that aligns with your financial goals and risk tolerance. Start building your diversified stock portfolio today and take control of your financial future.

When it comes to stock analysis, understanding how to use the P/E ratio is crucial. The P/E ratio, or price-to-earnings ratio, is a key metric that helps investors evaluate a company’s valuation. By comparing the stock price to the company’s earnings per share, investors can gauge whether a stock is overvalued or undervalued.

To learn more about how to use the P/E ratio in stock analysis, check out this comprehensive guide: How to use the P/E ratio in stock analysis.

When it comes to stock analysis, one of the key metrics that investors often look at is the Price-to-Earnings (P/E) ratio. Understanding how to use the P/E ratio in stock analysis can provide valuable insights into a company’s valuation and growth potential.

By comparing a company’s P/E ratio to its industry peers or historical averages, investors can make more informed decisions about whether a stock is undervalued or overvalued. To learn more about how to use the P/E ratio in stock analysis, check out this comprehensive guide How to use the P/E ratio in stock analysis.