Portfolio diversification using international stocks involves a strategic approach to investing that can enhance returns and minimize risks across global markets. By exploring the dynamics of international stock markets and the benefits of diversification, investors can unlock new opportunities for growth and stability in their portfolios.

Understanding the risks, challenges, and strategies associated with international stock investments is essential for building a well-rounded and resilient portfolio. This comprehensive guide delves into the intricacies of diversifying with international stocks to help you navigate the complexities of the global financial landscape.

Introduction to Portfolio Diversification with International Stocks

Portfolio diversification involves spreading investments across different assets to reduce risk. Adding international stocks to a portfolio is a strategy where investors invest in stocks from companies based in different countries. This can help mitigate country-specific risks and provide exposure to global economic growth opportunities.

Benefits of Diversifying with International Stocks, Portfolio diversification using international stocks

- Diversification of Geopolitical Risk: By investing in international stocks, investors can reduce their exposure to geopolitical risks specific to one country.

- Access to Diverse Markets: International stocks offer exposure to different markets, industries, and currencies, allowing for greater diversification.

- Potential for Higher Returns: Investing in international stocks can provide opportunities for higher returns due to growth prospects in emerging markets.

- Hedging Against Currency Risk: Holding international stocks denominated in different currencies can help hedge against currency fluctuations.

- Portfolio Risk Reduction: Adding international stocks to a portfolio can help reduce overall portfolio risk by spreading investments across different regions.

Understanding International Stock Markets

When diversifying a portfolio with international stocks, it is crucial to have a good understanding of the key international stock markets, how they compare to domestic markets, and the factors that influence their trends.

Key International Stock Markets

- The New York Stock Exchange (NYSE) in the United States is one of the largest stock exchanges in the world, offering a wide range of investment opportunities.

- The Tokyo Stock Exchange (TSE) in Japan is another major market, known for its technology and automotive companies.

- The London Stock Exchange (LSE) in the United Kingdom is a key player in European markets, offering access to companies from various industries.

- The Shanghai Stock Exchange (SSE) in China is one of the fastest-growing markets globally, with a focus on emerging industries.

Comparison with Domestic Markets

- International stock markets can provide diversification benefits by offering exposure to different economies, industries, and currencies compared to domestic markets.

- Performance in international markets may not always correlate with domestic markets, providing an opportunity for risk reduction through diversification.

Factors Influencing Trends

- Political stability and government policies can significantly impact international stock markets, affecting investor sentiment and market performance.

- Economic indicators such as GDP growth, inflation rates, and employment data can influence stock market trends in different countries.

- Global events like trade agreements, geopolitical tensions, and natural disasters can have ripple effects on international stock markets.

Risks and Challenges of Investing in International Stocks

Investing in international stocks can offer diversification benefits, but it also comes with its own set of risks and challenges. It’s important for investors to be aware of these factors before committing to such investments.

Currency Exchange Risk

Currency exchange risk is a significant factor to consider when investing in international stocks. Fluctuations in exchange rates can impact the value of investments, as changes in currency values can either increase or decrease returns for investors. For example, if the U.S. dollar strengthens against the foreign currency of the stock you’ve invested in, your returns may be negatively affected when converted back into dollars. It’s essential for investors to understand and manage this risk through strategies like hedging or diversification across multiple currencies.

Geopolitical Events Impact

Geopolitical events can have a substantial impact on international stock markets. Political instability, trade disputes, or conflicts in different parts of the world can create uncertainty and volatility in the markets. These events can lead to sudden and significant price movements in international stocks, affecting investors’ portfolios. It’s crucial for investors to stay informed about global events and their potential impact on the markets to make informed decisions and mitigate risks.

Strategies for Portfolio Diversification Using International Stocks

When it comes to diversifying a portfolio using international stocks, there are several strategies that investors can consider. These strategies can help mitigate risk and potentially enhance returns by spreading investments across different markets and regions.

Selecting International Stocks

One strategy for selecting international stocks to diversify a portfolio is to focus on countries with strong economic growth prospects. Emerging markets, for example, may offer higher growth potential but also come with increased risk. Developed markets, on the other hand, may provide more stability but potentially lower returns. It is important to research and analyze the political and economic conditions of the countries where the stocks are based to make informed decisions.

Importance of Asset Allocation

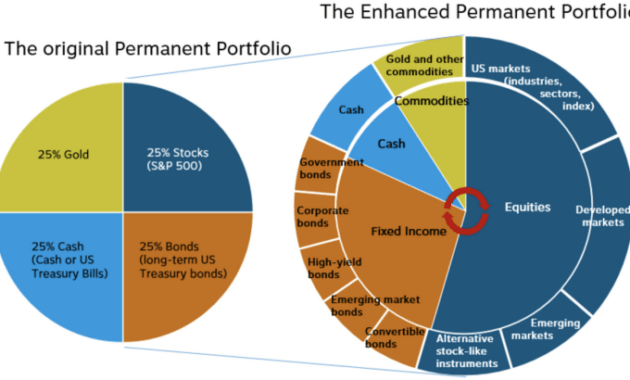

Asset allocation is crucial when incorporating international stocks into a portfolio. By spreading investments across different asset classes, such as stocks, bonds, and real estate, investors can reduce overall risk. Allocating a certain percentage of the portfolio to international stocks can help diversify exposure to specific market risks and potentially improve overall portfolio performance.

Rebalancing a Portfolio

Rebalancing a portfolio that includes international stocks is essential to maintain the desired asset allocation and risk profile. Market fluctuations can cause the weightings of different asset classes to shift over time. Investors should periodically review their portfolios and adjust allocations as needed to ensure they are in line with their investment goals and risk tolerance.

Final Review

In conclusion, embracing portfolio diversification through international stocks offers a pathway to building a robust investment portfolio that is resilient to market fluctuations and economic uncertainties. By incorporating a mix of international assets and implementing sound diversification strategies, investors can optimize their risk-adjusted returns and achieve long-term financial success.

When it comes to investing, one of the dilemmas that investors often face is whether to focus on growth stocks or value stocks. Investing in growth vs. value stocks requires a careful analysis of the company’s potential for future growth versus its current valuation.

Growth stocks typically offer higher potential returns but come with higher risks, while value stocks are usually undervalued and have the potential for long-term growth. Understanding the differences between these two types of stocks is crucial for building a well-rounded investment portfolio.

When it comes to investing, one of the key decisions to make is whether to focus on growth stocks or value stocks. Investing in growth vs. value stocks can have different risk and return profiles, so it’s important to understand the differences.

Growth stocks are typically companies that are expected to grow at a faster rate than the market average, while value stocks are seen as undervalued by the market. Both strategies have their own merits, and the choice between them depends on individual investment goals and risk tolerance.