Portfolio risk management strategies: In this comprehensive guide, we will delve into the crucial strategies that can help you protect your investment portfolio from potential risks and uncertainties. From understanding the basics to implementing advanced techniques, this article will equip you with the knowledge needed to make informed decisions and secure your financial future.

Portfolio Risk Management Strategies

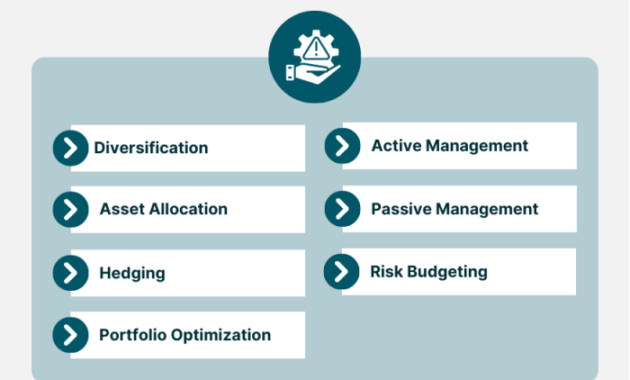

Portfolio risk management involves the process of identifying, assessing, and controlling risks that may impact an investment portfolio. By implementing risk management strategies, investors aim to protect their capital, minimize losses, and optimize returns.

Types of Risks in a Portfolio

When managing a portfolio, investors need to consider various types of risks that could affect their investments. These risks include market risk, credit risk, liquidity risk, inflation risk, and geopolitical risk. Each type of risk presents unique challenges and requires specific strategies to mitigate its impact.

- Market Risk: This type of risk arises from fluctuations in the overall market, such as changes in interest rates, economic conditions, or geopolitical events.

- Credit Risk: Credit risk refers to the potential for a borrower or issuer to default on their financial obligations, leading to losses for the investor.

- Liquidity Risk: Liquidity risk is the risk of not being able to buy or sell an investment quickly without causing a significant price change.

- Inflation Risk: Inflation risk is the risk that the real value of an investment will be eroded over time due to rising prices.

- Geopolitical Risk: Geopolitical risk stems from political instability, conflicts, or regulatory changes that can impact the value of investments.

Goals of Portfolio Risk Management

The primary goals of portfolio risk management include preserving capital, maintaining liquidity, achieving financial goals, and managing volatility. By effectively managing risks, investors can protect their investments during uncertain market conditions and enhance the overall performance of their portfolio.

Diversification: Portfolio Risk Management Strategies

Diversification is a risk management strategy that involves spreading investments across different assets, sectors, and geographic regions to reduce the overall risk of a portfolio. By diversifying, investors aim to minimize the impact of potential losses in any single investment by allocating their resources in a variety of areas.

Asset Allocation

Asset allocation is a diversification strategy that involves dividing a portfolio’s investments among different asset classes, such as stocks, bonds, and cash equivalents. This approach helps investors manage risk by balancing the potential returns and volatility of each asset class.

Sector Diversification

Sector diversification involves investing in various industry sectors, such as technology, healthcare, and energy. By spreading investments across different sectors, investors can reduce the impact of sector-specific risks and take advantage of opportunities in multiple areas of the economy.

Geographic Diversification

Geographic diversification is the practice of investing in different countries or regions to reduce the risk associated with political, economic, and currency factors in a specific location. By diversifying geographically, investors can protect their portfolios from country-specific events and take advantage of growth opportunities in multiple markets.

Successful diversification in risk management can be seen in the performance of a globally diversified portfolio during times of economic downturns or market volatility.

Asset Allocation

Asset allocation is the process of dividing an investment portfolio among different asset classes such as stocks, bonds, and cash equivalents. It is a crucial component of portfolio management as it helps in spreading risk and maximizing returns based on an investor’s goals, risk tolerance, and time horizon.

Impact of Asset Allocation on Portfolio Performance and Risk

Asset allocation has a significant impact on both the performance and risk of a portfolio. By diversifying across different asset classes, investors can reduce the overall volatility of their portfolio and potentially enhance returns. The right mix of assets can help balance risk and reward, ensuring that the portfolio is well-positioned to weather market fluctuations.

Strategic Asset Allocation vs. Tactical Asset Allocation

Strategic asset allocation involves setting target allocations for various asset classes based on long-term financial goals and risk tolerance. It is a more passive approach that requires periodic rebalancing to maintain the desired asset mix. On the other hand, tactical asset allocation involves adjusting the portfolio’s asset allocation based on short-term market conditions or opportunities. This approach requires more active management and may involve taking advantage of market trends or mispricings.

Best Practices for Effective Asset Allocation

– Regularly review and rebalance your portfolio to ensure it aligns with your investment objectives and risk tolerance.

– Consider your investment time horizon when determining your asset allocation strategy.

– Diversify across different asset classes to reduce concentration risk.

– Monitor market conditions and economic indicators to make informed decisions about asset allocation adjustments.

– Seek professional advice or use investment tools to help optimize your asset allocation based on your financial goals and risk profile.

Risk Assessment and Measurement

In portfolio management, risk assessment is a crucial process that involves identifying, analyzing, and quantifying potential risks that may impact the performance of an investment portfolio. By understanding the risks involved, investors can make informed decisions to manage and mitigate these risks effectively.

Key Metrics and Tools for Risk Measurement, Portfolio risk management strategies

Risk assessment in portfolio management relies on key metrics and tools to measure and quantify risks accurately. Some of the common metrics and tools used include:

- Standard Deviation: This metric measures the volatility or variability of returns of an investment portfolio. A higher standard deviation indicates higher risk.

- Beta: Beta measures the sensitivity of an investment portfolio to market movements. A beta of 1 indicates the portfolio moves in line with the market, while a beta greater than 1 indicates higher volatility.

- Value at Risk (VaR): VaR measures the maximum potential loss of an investment portfolio over a specified time horizon at a given confidence level. It helps investors understand the worst-case scenario of their investments.

Importance of Stress Testing and Scenario Analysis

Stress testing and scenario analysis play a crucial role in evaluating portfolio risks by simulating potential adverse market conditions. By subjecting the portfolio to various stress scenarios, investors can assess how different risks may impact the portfolio’s performance and identify areas of vulnerability. This proactive approach helps investors prepare for unexpected events and make informed decisions to mitigate risks effectively.

Examples of Risk Assessment Techniques

Real-world portfolio management often employs various risk assessment techniques to evaluate and manage risks effectively. Some examples include:

- Sensitivity Analysis: This technique assesses how changes in key variables, such as interest rates or commodity prices, may impact the portfolio’s performance.

- Monte Carlo Simulation: Monte Carlo Simulation generates multiple possible outcomes based on different variables and probabilities, providing a more comprehensive understanding of potential risks.

- Credit Risk Analysis: This technique assesses the creditworthiness of investments, such as bonds or loans, to determine the likelihood of default and potential losses.

Last Word

In conclusion, mastering portfolio risk management strategies is essential for any investor looking to navigate the complex world of finance with confidence and success. By implementing the right techniques and staying informed about market trends, you can effectively mitigate risks and optimize your investment outcomes.

When it comes to investing, conservative investors often look for safe stocks that provide stability and steady returns. These stocks are usually from well-established companies with a strong track record of performance. One such option for conservative investors is to consider investing in safe stocks for conservative investors that have a history of weathering market downturns and have a solid financial foundation.

When it comes to investing, conservative investors often seek safe stocks that provide stability and reliable returns. These stocks are typically from well-established companies with a history of consistent performance, making them less volatile than other investments. If you’re looking for safe stocks for conservative investors, consider checking out this comprehensive guide on safe stocks for conservative investors to help you make informed decisions for your investment portfolio.