Best strategies for stock portfolio management encompass a range of techniques to optimize investments and navigate the complexities of the stock market. From diversification to risk management, these strategies play a crucial role in achieving financial goals. Let’s delve into the key components that can help you make informed decisions and secure a prosperous future.

Importance of Diversification in a Stock Portfolio

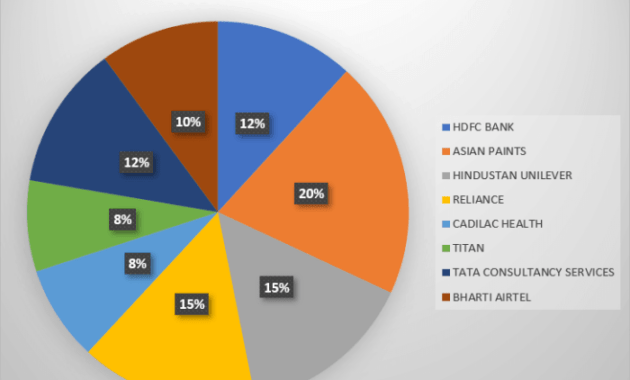

Diversification is a crucial strategy in stock portfolio management that involves spreading investments across different asset classes, industries, and geographic regions. The primary goal of diversification is to reduce risk by not putting all your eggs in one basket.

Mitigating Risk through Diversification

Diversification can help mitigate risk in various ways:

- Diversifying across industries: Investing in companies from different sectors can help offset losses in one industry with gains in another. For example, if the tech sector experiences a downturn, having investments in healthcare or consumer goods can help balance out the overall performance of your portfolio.

- Geographic diversification: Investing in companies from different countries or regions can protect your portfolio from being negatively impacted by economic or political events in a single location. This can help reduce the impact of localized risks such as currency fluctuations or regulatory changes.

- Asset class diversification: Allocating investments across different asset classes like stocks, bonds, and real estate can provide a buffer against market volatility. When one asset class underperforms, others may perform better, helping to stabilize your overall portfolio returns.

Types of Investment Strategies for Stock Portfolio Management

When it comes to managing a stock portfolio, investors have a variety of strategies to choose from based on their financial goals and risk tolerance. Let’s explore some of the most common types of investment strategies in stock portfolio management.

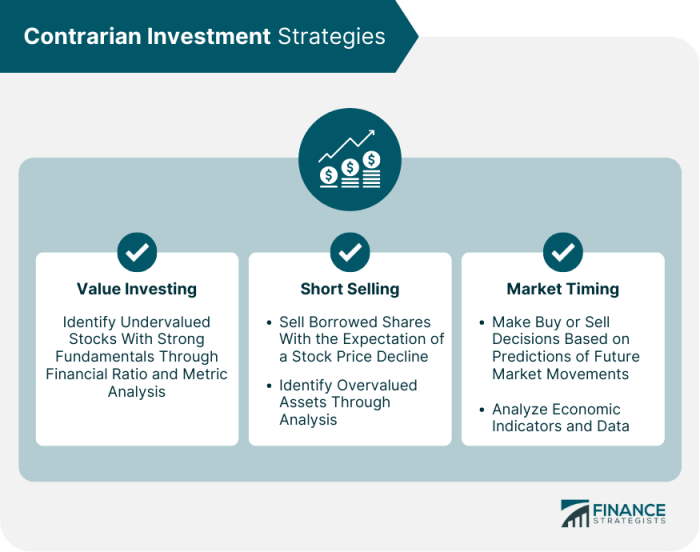

Value Investing

Value investing involves looking for undervalued stocks that are trading below their intrinsic value. Investors following this strategy believe that the market has temporarily mispriced these stocks, presenting an opportunity for long-term gains. Value investors typically focus on fundamental analysis, looking at metrics such as price-to-earnings ratio, price-to-book ratio, and dividend yield to identify potential investment opportunities.

Growth Investing

Growth investing, on the other hand, focuses on companies that are experiencing rapid earnings growth or are expected to do so in the future. Investors following this strategy are willing to pay a premium for stocks of companies with high growth potential, even if they may be trading at a higher valuation. Growth investors often look at metrics such as revenue growth, earnings growth, and return on equity to identify promising growth stocks.

Income Investing

Income investing is a strategy that aims to generate a steady stream of income from a stock portfolio, typically through dividends. Investors following this strategy prioritize stocks of companies with a history of paying dividends and stable cash flows. Income investors often look for stocks with high dividend yields and a track record of dividend growth.

Each of these investment strategies has its own set of characteristics and considerations, catering to different investor preferences and risk profiles. It’s essential for investors to understand these strategies and choose one that aligns with their financial goals and risk tolerance.

Risk Management Techniques for Stock Portfolio

Risk management is a crucial aspect of stock portfolio management, as it helps investors protect their capital and minimize potential losses. There are various techniques that investors can use to manage risks effectively and enhance their overall investment performance. Let’s explore some of these risk management strategies below.

Stop-Loss Orders

Stop-loss orders are a popular risk management technique used by investors to limit their losses on a particular investment. When placing a stop-loss order, investors specify a price at which they are willing to sell a stock to prevent further losses. This automated order helps investors avoid emotional decision-making during market volatility and ensures that losses are kept in check.

Asset Allocation

Asset allocation is another key risk management technique that involves diversifying investments across different asset classes, such as stocks, bonds, and cash equivalents. By spreading investments across a variety of asset classes, investors can reduce the overall risk of their portfolio. This strategy helps offset losses in one asset class with gains in another, providing a more stable and balanced investment approach.

Portfolio Rebalancing

Portfolio rebalancing is a risk management technique that involves periodically reviewing and adjusting the allocation of assets in a portfolio to maintain the desired level of risk exposure. By rebalancing a portfolio, investors can ensure that their risk profile aligns with their investment goals and risk tolerance. This practice helps prevent the portfolio from becoming too heavily weighted in a particular asset class, reducing the impact of market fluctuations on overall returns.

Diversification

Diversification is a fundamental risk management technique that involves spreading investments across different securities within the same asset class. By diversifying a stock portfolio, investors can reduce the impact of a single stock’s poor performance on the overall portfolio. Diversification helps investors minimize unsystematic risk, or the risk that is specific to a particular company or industry, and create a more resilient and balanced portfolio.

Monitoring and Rebalancing a Stock Portfolio

Regularly monitoring a stock portfolio is crucial to ensure that it aligns with your investment goals and risk tolerance. Without proper monitoring, you may miss out on opportunities to optimize your portfolio or protect it from potential risks.

Importance of Monitoring, Best strategies for stock portfolio management

Monitoring your stock portfolio allows you to stay informed about the performance of your investments, track market trends, and make informed decisions. By keeping a close eye on your portfolio, you can identify any underperforming assets, rebalance your holdings, and capitalize on emerging opportunities.

- Regularly review your portfolio performance against your investment objectives.

- Stay updated on market news and economic indicators that may impact your investments.

- Monitor the performance of individual stocks, sectors, and asset classes within your portfolio.

Guidelines for Rebalancing

Rebalancing a portfolio involves adjusting the allocation of assets to maintain the desired risk-return profile. It is essential to rebalance your portfolio periodically to ensure that it remains in line with your investment strategy and goals.

- Set a schedule for rebalancing, such as quarterly or annually, to avoid making impulsive decisions based on short-term market fluctuations.

- Rebalance your portfolio when the allocation of assets deviates significantly from your target percentages.

- Consider tax implications and transaction costs when rebalancing your portfolio to minimize expenses.

Long-Term vs. Short-Term Investing in Stock Portfolio Management: Best Strategies For Stock Portfolio Management

When it comes to managing a stock portfolio, investors often have to decide between long-term and short-term investing strategies. Each approach has its own set of advantages and disadvantages that should be carefully considered before making investment decisions.

Long-Term Investing

- Long-term investing involves holding onto stocks for an extended period, typically five years or more.

- This approach allows investors to benefit from the power of compounding over time, potentially leading to significant returns.

- Long-term investors are more focused on the fundamentals of the companies they invest in, rather than short-term price fluctuations.

- One key advantage of long-term investing is lower tax rates on capital gains for investments held for over a year.

Short-Term Investing

- Short-term investing, on the other hand, involves buying and selling stocks within a shorter time frame, often days, weeks, or months.

- This strategy is more focused on taking advantage of short-term price movements in the market to make quick profits.

- Short-term investors may use technical analysis and market trends to make trading decisions, rather than company fundamentals.

- One disadvantage of short-term investing is higher tax rates on capital gains for investments held for less than a year.

Final Conclusion

In conclusion, mastering the best strategies for stock portfolio management is essential for long-term success in the financial realm. By implementing these tactics effectively, investors can build a robust portfolio and weather market fluctuations with confidence. Stay informed, stay proactive, and watch your investments flourish.

When it comes to investing, penny stocks with high potential can offer great opportunities for investors looking to maximize their returns. These low-priced stocks have the potential to skyrocket in value, providing significant profits to those who are able to identify them early on.

However, it’s important to conduct thorough research and due diligence before investing in these high-risk stocks. By staying informed and keeping a close eye on market trends, investors can increase their chances of success with penny stocks with high potential.

Learn more about these opportunities here.

When it comes to investing in the stock market, many investors are drawn to penny stocks with high potential. These low-priced stocks have the possibility of yielding significant returns, but they also come with a higher level of risk. It’s important for investors to do their research and due diligence before diving into this volatile market.

If you’re interested in exploring penny stocks with high potential, you can check out this informative article on Penny stocks with high potential for some valuable insights.