Safe stocks for conservative investors is a crucial topic that delves into the characteristics of secure investments, financial analysis strategies, diversification techniques, and long-term investment approaches. This comprehensive guide aims to provide insights for investors seeking stability and low volatility in their portfolios.

As we explore the world of safe stocks, we uncover the key factors that conservative investors should consider to make informed decisions and build a resilient investment portfolio.

Factors to Consider for Conservative Investors

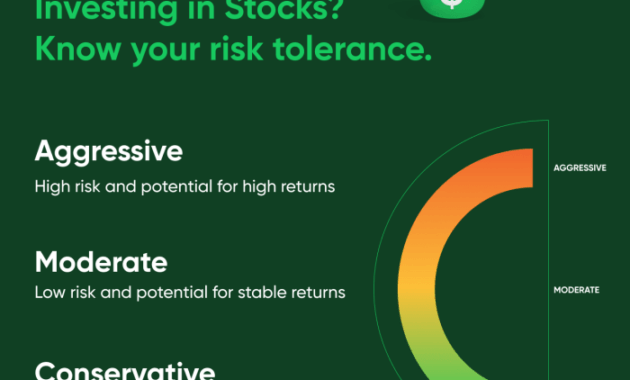

When it comes to investing in stocks, conservative investors prioritize safety and stability over high returns. Here are some factors they consider:

Characteristics of Safe Stocks

Safe stocks typically have strong fundamentals, consistent earnings growth, and a solid track record of dividend payments. These companies are often industry leaders with a competitive advantage that sets them apart from their peers.

Importance of Stability and Low Volatility

For conservative investors, stability and low volatility are key factors in determining the safety of a stock. Stocks with stable prices and low volatility are less likely to experience significant fluctuations, reducing the risk of capital loss.

Past Performance as an Indicator of Safety

Looking at a stock’s past performance can provide valuable insights into its safety for investors. A stock with a history of steady growth and consistent returns is more likely to be considered safe by conservative investors.

Examples of Industries with Safe Stocks

Certain industries are typically associated with safe stocks, such as consumer staples, utilities, and healthcare. These sectors tend to be less cyclical and more resilient to economic downturns, making them attractive to conservative investors seeking stability in their portfolios.

Fundamental Analysis for Safe Stocks

When considering safe stocks for conservative investors, fundamental analysis plays a crucial role in assessing the financial health and stability of a company. By analyzing key financial ratios and evaluating the company’s balance sheet, investors can make informed decisions to minimize risk and preserve capital.

Key Financial Ratios

- The Price-to-Earnings (P/E) ratio: This ratio indicates how much investors are willing to pay for each dollar of earnings. A lower P/E ratio may suggest that a stock is undervalued, making it potentially safer for conservative investors.

- Dividend Yield: The dividend yield is the annual dividend payment divided by the stock price. A higher dividend yield can be attractive for conservative investors seeking income and stability.

- Debt-to-Equity Ratio: This ratio compares a company’s total debt to its shareholders’ equity. A lower debt-to-equity ratio is generally considered safer, as it indicates lower financial leverage and less risk of default.

Evaluating a Company’s Balance Sheet

- Look for a strong cash position: A healthy amount of cash on hand can provide a cushion during economic downturns or unexpected expenses.

- Assess long-term debt levels: A company with manageable long-term debt is less likely to face financial distress or bankruptcy.

- Check for consistent profitability: Consistent earnings growth over time indicates a stable and well-managed company with the potential for long-term success.

Significance of Consistent Earnings Growth

Consistent earnings growth is crucial for conservative investors as it demonstrates a company’s ability to generate profits year after year. This stability can provide confidence that the company is well-positioned to weather market fluctuations and economic challenges, making it a safer investment option for those seeking capital preservation.

Diversification Strategies for Conservative Portfolios

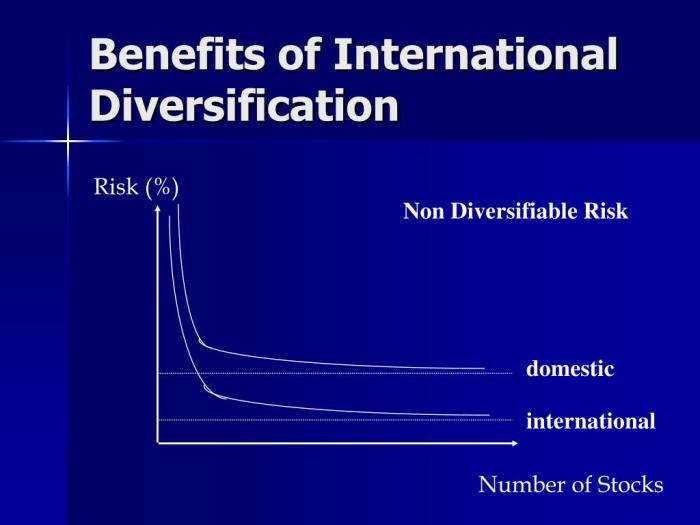

When it comes to conservative investing, diversification is key to managing risk and ensuring a stable return on investment. By spreading your funds across different sectors and asset classes, you can protect your portfolio from the volatility of individual stocks or industries. Here are some guidelines on how to effectively diversify your conservative portfolio:

Benefits of Diversifying Investments in Safe Stocks, Safe stocks for conservative investors

Diversification helps reduce the risk of significant losses by spreading investments across different assets. By investing in a variety of safe stocks, conservative investors can minimize the impact of downturns in any single stock or sector.

Guidelines on Allocating Funds Across Different Sectors for Safety

It is recommended to allocate funds across various sectors such as healthcare, consumer staples, utilities, and technology. This ensures that your portfolio is not overly exposed to the risks of a particular industry. By diversifying across sectors, you can protect your investments from sector-specific downturns.

Role of Index Funds and ETFs in Diversifying a Conservative Portfolio

Index funds and ETFs are excellent tools for diversifying a conservative portfolio. These funds provide exposure to a broad range of stocks within an index or sector. By investing in index funds or ETFs, conservative investors can achieve instant diversification without having to pick individual stocks.

How Diversification Can Mitigate Risks for Conservative Investors

Diversification spreads risk across different assets, reducing the impact of any single investment on the overall portfolio. By investing in a mix of safe stocks, bonds, and other assets, conservative investors can achieve a more balanced and stable portfolio. Diversification helps safeguard against unexpected market movements and provides a buffer against volatility.

Long-Term Investment Approach: Safe Stocks For Conservative Investors

Investing with a long-term perspective can be highly beneficial for conservative investors looking to build wealth steadily over time. This approach involves buying quality stocks and holding onto them for an extended period, allowing them to grow and compound returns. Patience and discipline are key components of this strategy, as short-term market fluctuations are often smoothed out over the years.

Advantages of Buy-and-Hold Strategy

- Minimizes trading costs and taxes, leading to higher overall returns.

- Reduces the impact of market volatility on investment performance.

- Allows investors to benefit from the power of compounding over time.

Importance of Patience and Discipline

- Helps investors stay focused on long-term goals despite short-term market noise.

- Prevents emotional decision-making and impulse selling during market downturns.

- Encourages consistent contributions to investment accounts for growth.

Examples of Safe Stocks with Consistent Growth

- Johnson & Johnson (JNJ): A diversified healthcare company with a long history of stable growth and dividend payments.

- Procter & Gamble (PG): A consumer goods giant known for its strong brands and steady cash flows.

- Microsoft (MSFT): A technology leader that has consistently delivered value to shareholders over the years.

Compounding Returns in the Long Run

-

Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it. – Albert Einstein

- Consistent reinvestment of dividends and capital gains can significantly boost overall returns over time.

- Long-term investors benefit greatly from the snowball effect of compounding, where gains generate more gains.

Conclusion

In conclusion, Safe stocks for conservative investors offer a pathway to financial security and peace of mind. By understanding the nuances of safe investments, investors can navigate the market with confidence and achieve their long-term financial goals.

Are you looking to learn how to invest in dividend stocks to grow your wealth? Investing in dividend stocks can provide you with a steady stream of passive income. By selecting the right companies with a history of consistent dividend payments, you can build a portfolio that generates reliable returns over time.

Check out this comprehensive guide on How to invest in dividend stocks to get started on your investment journey.

Looking to grow your wealth through investments? One popular strategy is to invest in dividend stocks. By choosing companies with a history of paying out dividends to shareholders, you can earn passive income while benefiting from potential stock price appreciation.

Learn more about how to invest in dividend stocks and start building a diversified portfolio today.