Delving into Defensive stocks during market downturns, this introduction immerses readers in a unique and compelling narrative, with a focus on understanding how certain stocks weather market challenges with strength and stability. As investors seek stability in uncertain times, exploring defensive stocks can provide valuable insights into navigating market downturns effectively.

Exploring the characteristics, performance, and strategies related to defensive stocks offers a comprehensive view of how these assets can play a crucial role in an investment portfolio. By understanding the nuances of defensive stocks, investors can make informed decisions to protect their investments during turbulent market conditions.

Overview of Defensive Stocks: Defensive Stocks During Market Downturns

Defensive stocks are a category of stocks that tend to remain stable and even perform well during market downturns or economic recessions. These stocks are known for their resilience and ability to provide consistent returns regardless of market conditions.

Investors looking for stable and reliable investments in 2024 should consider the top blue-chip stocks in the market. These companies are known for their strong financial performance and established track record. To find out more about the top blue-chip stocks to watch in 2024, check out this comprehensive guide on Top blue-chip stocks in 2024.

Characteristics of Defensive Stocks

Defensive stocks typically exhibit the following characteristics that make them attractive to investors during turbulent times:

- Stable demand for products or services: Companies that offer essential goods or services that consumers need regardless of economic conditions are considered defensive stocks.

- Strong cash flow and low debt levels: Defensive stocks often have healthy balance sheets with ample cash reserves to weather economic storms.

- Dividend payments: Many defensive stocks pay steady dividends, providing investors with a source of income even when stock prices are volatile.

- Non-cyclical industries: Defensive stocks are usually found in industries that are less sensitive to economic cycles, such as healthcare, utilities, and consumer staples.

Examples of Defensive Stocks

Some industries or sectors that typically contain defensive stocks include:

| Industry/Sector | Examples of Defensive Stocks |

|---|---|

| Healthcare | Johnson & Johnson, Pfizer, Merck & Co. |

| Utilities | NextEra Energy, Duke Energy, American Electric Power |

| Consumer Staples | The Coca-Cola Company, Procter & Gamble, PepsiCo |

Factors Influencing Defensive Stocks

When it comes to defensive stocks, there are several factors that can influence their performance. Economic indicators, interest rates, and geopolitical events all play a role in determining the attractiveness of these stocks to investors.

Economic Indicators Impact

Economic indicators such as GDP growth, unemployment rates, and consumer confidence can have a significant impact on defensive stocks. In times of economic uncertainty or recession, investors tend to flock to defensive stocks as they are seen as more stable and less affected by overall market fluctuations.

Relationship with Interest Rates

Interest rates also play a crucial role in influencing defensive stocks. Typically, when interest rates are low, defensive stocks become more attractive to investors seeking steady income and capital preservation. On the other hand, rising interest rates can make these stocks less appealing as borrowing costs increase and the opportunity cost of holding defensive stocks rises.

Geopolitical Events Influence, Defensive stocks during market downturns

Geopolitical events such as trade wars, political instability, or global conflicts can impact the attractiveness of defensive stocks. During times of uncertainty or heightened geopolitical tensions, investors may turn to defensive stocks as a safe haven to protect their investments from potential market volatility.

Performance of Defensive Stocks During Market Downturns

When it comes to market downturns, investors often turn to defensive stocks as a safe haven for their portfolios. These stocks are known for their ability to provide stable returns and protect investors’ capital during turbulent times in the market.

Analyze historical data to showcase how defensive stocks have performed in past market downturns

Historical data has consistently shown that defensive stocks tend to outperform other types of stocks during market downturns. This is because companies in sectors such as utilities, consumer staples, and healthcare typically have stable earnings and strong cash flows, making them less vulnerable to economic downturns.

Compare the performance of defensive stocks with other types of stocks during bear markets

During bear markets, defensive stocks have historically exhibited lower volatility and smaller declines compared to more cyclical stocks such as technology or industrials. This relative stability can help investors weather the storm and preserve their wealth during challenging market conditions.

Provide examples of specific defensive stocks that have shown resilience in challenging market conditions

Examples of defensive stocks that have demonstrated resilience during market downturns include companies like Procter & Gamble, Johnson & Johnson, and Coca-Cola. These companies have strong brand recognition, loyal customer bases, and products that are in demand regardless of economic conditions, making them attractive options for defensive investors.

Strategies for Investing in Defensive Stocks

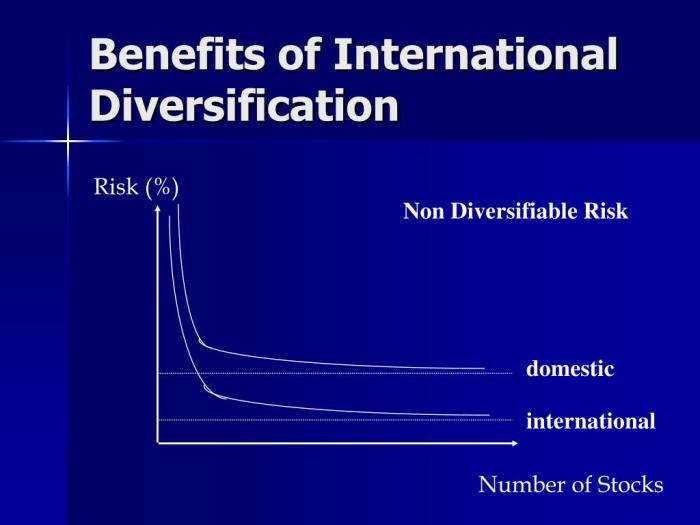

When it comes to incorporating defensive stocks into your investment portfolio, there are several strategies that investors can consider. Diversification is key when including defensive stocks to mitigate risk, and identifying strong defensive stocks is crucial for long-term investment goals.

Diversification in Defensive Stocks

Diversification is essential when investing in defensive stocks to ensure that your portfolio is not overly exposed to a single sector or market. By spreading your investments across different industries, you can reduce the impact of any downturn in a particular sector on your overall portfolio. This strategy helps to minimize risk and protect your investments against market volatility.

Identifying Strong Defensive Stocks

When looking for strong defensive stocks, investors should consider companies with stable earnings, strong cash flows, and a history of paying dividends. These companies typically belong to sectors such as utilities, consumer staples, and healthcare, which tend to perform well even during economic downturns. Additionally, analyzing a company’s balance sheet, competitive position, and management team can help identify resilient stocks that are well-positioned for long-term growth.

Closing Notes

In conclusion, Defensive stocks during market downturns offer a beacon of stability and resilience in a sea of market volatility. By incorporating defensive stocks into investment strategies and understanding their unique qualities, investors can better prepare for and navigate through challenging market environments with confidence and composure.

When it comes to investing, keeping an eye on the top blue-chip stocks is crucial for long-term success. In 2024, investors are closely watching companies like Apple, Amazon, and Microsoft. These industry giants have a proven track record of stability and growth, making them attractive options for those looking to build a strong portfolio.

To learn more about the top blue-chip stocks in 2024, check out this comprehensive guide: Top blue-chip stocks in 2024.