Interpreting economic data for Forex sets the stage for understanding how various economic indicators impact currency movements, providing traders with valuable insights for successful trading strategies. Dive into the world of Forex trading with a focus on interpreting economic data to enhance your trading decisions.

Understanding Economic Indicators for Forex

Economic indicators play a crucial role in Forex trading as they provide valuable insights into the health of an economy and influence currency movements. Traders and investors closely monitor these indicators to make informed decisions and predict future market trends.

Key Economic Indicators

- Gross Domestic Product (GDP): GDP measures the economic performance of a country and has a significant impact on currency values. A growing GDP usually strengthens a currency, while a declining GDP can weaken it.

- Unemployment Rate: The unemployment rate reflects the health of the labor market and overall economy. High unemployment rates can lead to decreased consumer spending and a weaker currency.

- Inflation Rate: Inflation measures the rate at which prices of goods and services increase. High inflation rates can erode purchasing power and weaken a currency.

- Interest Rates: Central banks use interest rates to control inflation and stimulate economic growth. Changes in interest rates can have a direct impact on currency values.

Effect on Currency Pairs

- US Dollar (USD): Economic indicators such as GDP, interest rates, and employment data have a significant impact on the value of the US dollar. Traders often closely watch these indicators to predict USD movements.

- Euro (EUR): For the Euro, indicators like the Eurozone GDP, inflation rate, and political stability play a key role in determining the strength of the currency against other pairs.

- Japanese Yen (JPY): Economic indicators such as the Japanese GDP, trade balance, and monetary policy decisions by the Bank of Japan can influence the value of the Yen in the Forex market.

Analyzing GDP Data for Forex Trading: Interpreting Economic Data For Forex

When it comes to Forex trading, analyzing GDP data is crucial for understanding the economic health of a country and making informed trading decisions based on this key indicator. GDP, or Gross Domestic Product, is a measure of the total economic output of a country and is used by traders to gauge the overall health and growth potential of an economy.

Relationship between GDP Data and Currency Value Fluctuations

GDP data releases can have a significant impact on currency value fluctuations. A higher than expected GDP growth rate can lead to an increase in the value of a country’s currency, as it suggests a strong and growing economy. On the other hand, a lower than expected GDP growth rate can lead to a decrease in currency value, signaling potential economic weakness.

- Positive GDP data: Traders may interpret this as a sign of a healthy economy and potential interest rate hikes, leading to an increase in demand for the currency.

- Negative GDP data: Traders may view this as a red flag for the economy, potentially causing a decrease in currency value as investors seek safer assets.

It’s important for traders to keep a close eye on GDP data releases and how they compare to market expectations to anticipate potential currency movements.

Interpreting GDP Data for Forex Trading

Traders analyze GDP data in comparison to previous releases and market expectations to make trading decisions. For example, if GDP growth is higher than expected, traders may go long on the currency in anticipation of a stronger economy. Conversely, if GDP growth is lower than expected, traders may short the currency in anticipation of a weakening economy.

| Scenario | Interpretation |

|---|---|

| GDP growth exceeds expectations | Positive outlook for currency, potential long positions |

| GDP growth falls short of expectations | Negative outlook for currency, potential short positions |

Interpreting Interest Rates for Forex Markets

Interest rates play a crucial role in the forex market as they impact currency exchange rates. When a country’s central bank changes its interest rates, it affects the value of its currency.

Raising interest rates typically leads to an appreciation of the country’s currency. This is because higher interest rates attract foreign investors looking for better returns on their investments. As a result, there is an increased demand for the currency, driving up its value in the forex market.

Conversely, lowering interest rates often leads to a depreciation of the country’s currency. Lower interest rates make investments in that country less attractive, leading to a decrease in demand for the currency and a decline in its value in the forex market.

Anticipating Currency Movements based on Interest Rate Announcements, Interpreting economic data for Forex

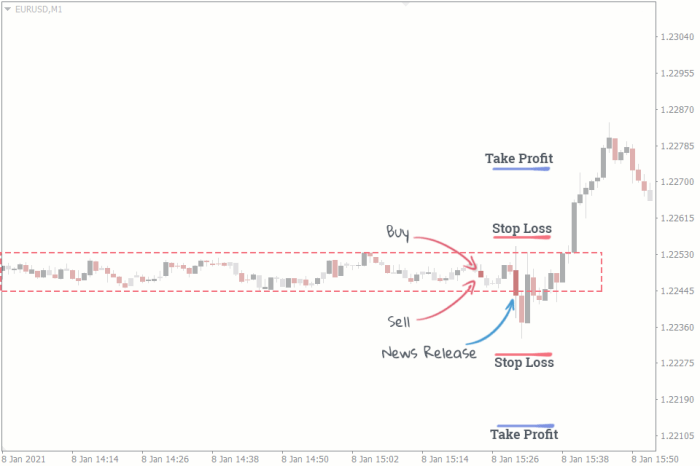

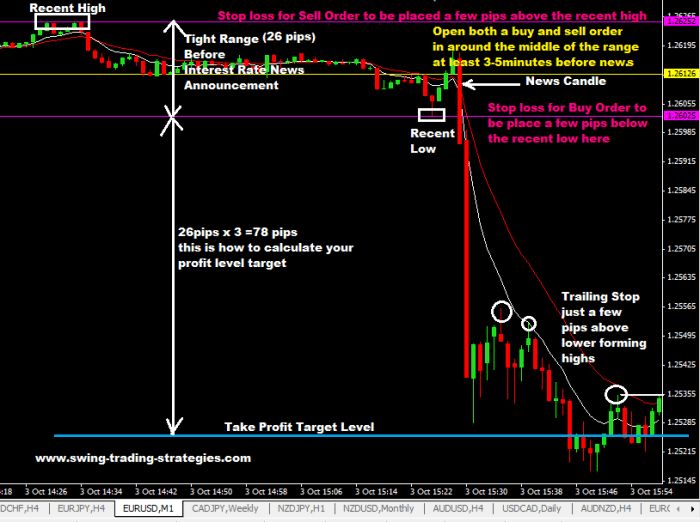

Traders can anticipate currency movements by closely monitoring interest rate announcements from central banks. Here are some key points to consider:

- Forward Guidance: Central banks often provide guidance on future interest rate decisions. Traders analyze this guidance to predict how interest rates may change in the future and adjust their trading positions accordingly.

- Market Expectations: Traders also pay attention to market expectations regarding interest rate decisions. If the actual decision aligns with market expectations, it may have a muted impact on the currency. However, if there is a surprise decision, it can lead to significant currency movements.

- Economic Data: Traders assess economic data releases to gauge the health of an economy. Strong economic data may lead to speculation of potential interest rate hikes, while weak data could signal rate cuts, impacting the currency’s value.

Using Inflation Data in Forex Analysis

Inflation data plays a crucial role in shaping market sentiment within the Forex industry. Traders closely monitor inflation rates as they can have a significant impact on currency valuations and overall market trends. Understanding how inflation data influences Forex analysis is essential for making informed trading decisions.

Relationship Between Inflation Rates and Currency Valuation

Inflation rates and currency valuation are inherently linked. Generally, currencies in countries with higher inflation rates tend to depreciate in value compared to those with lower inflation rates. This is because high inflation erodes the purchasing power of a currency, leading investors to seek more stable currencies to protect their investments. As a result, currencies in countries with lower inflation rates are often perceived as more attractive to investors, leading to an increase in demand and, consequently, a higher valuation.

- When inflation rates rise, the central bank may respond by increasing interest rates to curb inflation. This can lead to a stronger currency as higher interest rates attract foreign investment.

- Conversely, low inflation rates may prompt central banks to lower interest rates, which can weaken a currency as investors seek higher returns elsewhere.

- Traders need to consider not only the current inflation data but also future expectations. Anticipating changes in inflation rates can help traders predict currency movements and adjust their trading strategies accordingly.

Strategies for Traders to Incorporate Inflation Data

Traders can incorporate inflation data into their Forex analysis in several ways to gain a deeper understanding of market dynamics and make more informed decisions.

- Monitor inflation reports: Keeping track of scheduled inflation reports and releases from central banks can provide valuable insights into current and future inflation trends.

- Compare inflation rates across currencies: Analyzing inflation differentials between countries can help traders identify potential trading opportunities based on expected currency movements.

- Use inflation data in conjunction with other economic indicators: Combining inflation data with other key economic indicators such as GDP growth, employment figures, and interest rates can provide a comprehensive view of the overall economic health of a country and its currency.

- Stay informed about monetary policy decisions: Understanding how central banks respond to inflation data through monetary policy decisions can help traders anticipate market reactions and adjust their positions accordingly.

Closing Summary

In conclusion, mastering the art of interpreting economic data for Forex can give traders a competitive edge in the dynamic currency markets, allowing for informed decision-making and strategic moves to navigate the complexities of trading. Stay informed, stay ahead in your Forex trading journey.

When it comes to trading the AUD/USD pair, it is essential to understand the factors influencing the Australian dollar and the US dollar. The relationship between the two economies, commodity prices, interest rates, and geopolitical events all play a significant role in the movement of this currency pair.

Traders need to stay informed about economic indicators and market trends to make informed decisions. For more insights on trading the AUD/USD pair, check out this detailed guide on Trading AUD/USD pair.

When it comes to trading the AUD/USD pair, it’s essential to understand the factors that can influence its movements. From interest rate differentials to economic data releases, traders need to stay informed to make informed decisions. By keeping an eye on market trends and using technical analysis tools, traders can better navigate the volatility of this popular currency pair.

For more insights on trading the AUD/USD pair, check out this informative guide on Trading AUD/USD pair.