Analyzing central bank policies for Forex sets the stage for a deep dive into the intricate world of Forex market dynamics, shedding light on the crucial role central banks play in shaping global currency movements. From economic indicators to policy tools, this exploration promises to unveil the hidden connections and influences that drive the Forex market.

Delve into the realm of central bank policies and discover the underlying factors that dictate the ebb and flow of currency values, unveiling a world of complexities and strategies that govern the Forex landscape.

Factors influencing central bank policies in the Forex market

Central bank policies in the Forex market are influenced by a variety of factors that shape their decision-making process. These factors play a crucial role in determining the overall economic landscape and impact currency valuations. Let’s explore some of the key influences on central bank policies in the Forex market.

Impact of economic indicators on policy decisions

Economic indicators such as GDP growth, employment data, and consumer spending play a significant role in shaping central bank policies in the Forex market. Positive economic indicators may lead central banks to raise interest rates to control inflation, which can strengthen the domestic currency. Conversely, negative economic data may prompt central banks to implement monetary easing measures to stimulate the economy, potentially weakening the currency.

Geopolitical events influencing central bank policies, Analyzing central bank policies for Forex

Geopolitical events such as trade disputes, political unrest, and natural disasters can have a profound impact on central bank policies in the Forex market. Uncertainty stemming from geopolitical events can lead central banks to adjust their monetary policies to mitigate risks and stabilize the currency. For example, heightened geopolitical tensions may prompt central banks to intervene in the foreign exchange market to support the currency.

Role of inflation rates in shaping Forex policies

Inflation rates are a key consideration for central banks when formulating Forex policies. Central banks aim to maintain price stability by keeping inflation within a target range. High inflation can erode the value of a currency, leading central banks to tighten monetary policy to curb inflationary pressures. On the other hand, low inflation or deflation may prompt central banks to adopt accommodative policies to stimulate economic growth and prevent a currency from becoming too strong.

Tools used by central banks to implement Forex policies

Central banks utilize a variety of tools to implement Forex policies, with the goal of achieving monetary stability and influencing exchange rates in the market.

Interest Rates as a Policy Tool

Interest rates are a crucial tool used by central banks to influence Forex markets. By adjusting interest rates, central banks can affect borrowing costs, inflation rates, and ultimately impact the value of a country’s currency. For instance, a central bank may raise interest rates to attract foreign investment, leading to an appreciation of the domestic currency. Conversely, lowering interest rates can stimulate economic growth but may result in a depreciation of the currency.

Quantitative Easing and its Effects on Forex Markets

Quantitative easing is another policy tool used by central banks to stimulate the economy. This involves the central bank purchasing financial assets, such as government bonds, to increase the money supply and lower long-term interest rates. The effects of quantitative easing on Forex markets can be significant, as it can lead to a devaluation of the domestic currency due to the increased money supply. However, it can also boost exports and economic growth in the short term.

Forward Guidance for Communicating Policy Intentions

Forward guidance is a communication tool used by central banks to provide guidance on future monetary policy decisions. By signaling their intentions regarding interest rates and other policy measures, central banks can influence market expectations and help stabilize exchange rates. Clear and consistent forward guidance can help reduce uncertainty in the Forex market, leading to more predictable outcomes for investors and traders.

Effects of central bank policies on Forex market participants

Central bank policies have a significant impact on Forex market participants, including traders, investors, and institutions. These policies can influence market sentiment, trading strategies, and overall market dynamics.

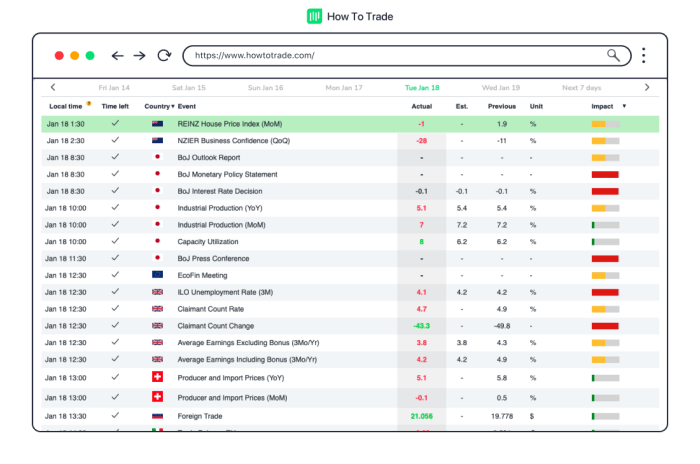

Traders’ reaction to central bank announcements

Traders closely monitor central bank announcements, especially regarding interest rate decisions, quantitative easing programs, and forward guidance. Positive news, such as interest rate hikes or optimistic economic outlooks, can lead to a strengthening of the domestic currency. Conversely, negative announcements, such as unexpected rate cuts or dovish statements, can result in currency depreciation. Traders often adjust their positions based on these announcements, leading to increased volatility in the Forex market.

Impact of policy divergence among central banks on currency pairs

Policy divergence occurs when central banks in different countries pursue contrasting monetary policies. This can lead to significant movements in currency pairs, as traders adjust their positions to take advantage of interest rate differentials. For example, if one central bank raises interest rates while another maintains a dovish stance, the currency of the former is likely to appreciate against the latter. Traders carefully analyze policy divergence to identify trading opportunities and manage risk effectively.

Influence of central bank policies on market sentiment

Central bank policies can shape market sentiment by providing insights into the economic outlook, inflation expectations, and future policy direction. Positive policies, such as tightening measures to control inflation or support economic growth, can boost investor confidence and lead to a bullish market sentiment. On the other hand, negative policies, such as accommodative measures to stimulate the economy, may create uncertainty and result in a bearish sentiment. Traders closely follow central bank communications and policy decisions to gauge market sentiment and plan their trading strategies accordingly.

Challenges faced by central banks in managing Forex policies: Analyzing Central Bank Policies For Forex

Central banks play a crucial role in managing Forex policies to stabilize their country’s economy and maintain financial stability. However, they face several challenges in achieving their policy objectives due to the complexities of the global market.

Difficulties in achieving policy objectives in a global market

Central banks often struggle to achieve their policy objectives in a global market due to the interconnected nature of economies. Changes in one country can have ripple effects across the world, making it challenging to control exchange rates and inflation levels effectively.

- Global economic imbalances can impact the effectiveness of central bank policies.

- Market speculation and volatility can undermine policy measures.

- Divergent monetary policies among different countries can complicate coordination efforts.

Risks associated with unconventional policy measures

Central banks sometimes resort to unconventional policy measures to address economic challenges, but these come with inherent risks that can impact the Forex market significantly.

- Quantitative easing can lead to currency devaluation and inflation risks.

- Negative interest rates can distort market signals and incentivize risky behavior.

- Forward guidance may create uncertainty and market distortions.

Limitations of central bank interventions in the Forex market

Despite their efforts, central banks face limitations when intervening in the Forex market, which can hinder their ability to achieve desired outcomes.

- Market size and liquidity constraints can limit the impact of interventions.

- Unpredictable market reactions to policy announcements can undermine effectiveness.

- Policy spillovers and unintended consequences can complicate the implementation of measures.

Ending Remarks

As we conclude our exploration of central bank policies for Forex, it becomes evident that the intricate interplay between economic indicators, policy tools, and market reactions creates a dynamic environment for traders and investors alike. By understanding the nuances of central bank interventions, one can navigate the volatile Forex market with greater insight and confidence.

When it comes to trading in the forex market, one popular tool used by traders is Bollinger Bands. These bands are a technical analysis tool that can help traders identify potential entry and exit points based on volatility levels. By using Bollinger Bands in Forex, traders can better understand market trends and make more informed trading decisions.

To learn more about how to effectively use Bollinger Bands in your trading strategy, check out this comprehensive guide on Using Bollinger Bands in Forex.

When it comes to trading in the Forex market, one popular tool that traders use is Bollinger Bands. These bands are a technical analysis tool that helps traders identify potential entry and exit points based on volatility levels. By using Bollinger Bands in Forex, traders can better understand market trends and make informed decisions.

To learn more about how to effectively utilize Bollinger Bands in your trading strategy, check out this comprehensive guide on Using Bollinger Bands in Forex.