Economic calendar for Forex traders takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Understanding the impact of economic events on currency movements is crucial for Forex traders looking to make informed decisions. This guide will explore the significance of staying updated with economic calendars and how to effectively use them for trading purposes.

Importance of Economic Calendars for Forex Traders

Economic calendars play a crucial role in the daily operations of Forex traders, providing them with valuable insights into the economic events that may impact currency movements. By staying updated with economic calendars, traders can make more informed decisions and adjust their trading strategies accordingly.

Significance of Staying Updated with Economic Events

Economic calendars help Forex traders keep track of important economic indicators and events, such as interest rate decisions, GDP releases, employment reports, and inflation data. By monitoring these events, traders can anticipate market volatility and adjust their positions to minimize risks and capitalize on potential opportunities.

- Interest Rate Decisions: Central banks’ decisions on interest rates can have a significant impact on currency movements. Traders closely monitor these announcements to gauge the health of the economy and adjust their positions accordingly.

- GDP Releases: Gross Domestic Product (GDP) reports provide insights into the overall health of an economy. Positive GDP growth can strengthen a currency, while negative growth can weaken it.

- Employment Reports: Job data, such as non-farm payrolls, unemployment rates, and job creation numbers, can influence market sentiment and currency valuations. Traders use this information to assess the strength of an economy.

- Inflation Data: Inflation reports, such as Consumer Price Index (CPI) and Producer Price Index (PPI), can impact central banks’ monetary policy decisions. Traders analyze inflation data to predict future interest rate changes.

Impact of Economic Data Releases on Currency Movements

Economic data releases have the potential to cause significant fluctuations in currency prices. Positive economic data can strengthen a currency, while negative data can weaken it. Traders often react swiftly to economic announcements, leading to increased volatility in the Forex market.

It is essential for Forex traders to stay informed about economic events and data releases to make well-informed trading decisions and navigate the dynamic nature of the currency markets.

Key Indicators Found in Economic Calendars

When it comes to analyzing the impact of economic events on the Forex market, traders rely heavily on economic calendars. These calendars contain a variety of key indicators that provide valuable insights into the economic health of a country, influencing currency pairs in the process.

Interest Rate Decisions

Interest rate decisions by central banks are one of the most critical indicators for Forex traders. Central banks use interest rates to control inflation, economic growth, and currency value. A higher interest rate typically strengthens a currency, while a lower interest rate can weaken it.

When it comes to trading breakouts, it is essential to have a solid strategy in place. One effective approach is to wait for a breakout above a key resistance level before entering a long position. This can help ensure that the breakout is genuine and not a false signal.

Additionally, setting stop-loss orders can help manage risk and protect profits. To learn more about how to trade breakouts effectively, check out this detailed guide on How to trade breakouts.

Employment Reports

Employment reports, such as non-farm payrolls in the U.S., are closely watched by Forex traders. These reports provide information on job creation, unemployment rates, and wage growth, offering insights into the overall health of the economy. Positive employment data can lead to a stronger currency.

Gross Domestic Product (GDP)

GDP is a key indicator of economic performance and growth. It measures the total value of all goods and services produced in a country. A growing GDP indicates a healthy economy, which can lead to a stronger currency, while a shrinking GDP may weaken a currency.

Inflation Data

Inflation data, such as the Consumer Price Index (CPI), measures the changes in the prices of goods and services over time. High inflation can erode the purchasing power of a currency, leading to its devaluation. Central banks use inflation data to make decisions on interest rates.

When it comes to trading breakouts, it’s essential to have a solid strategy in place. One effective approach is to wait for a stock price to break above a key resistance level before entering a trade. This signals a potential uptrend and can lead to profitable opportunities.

To learn more about how to trade breakouts successfully, check out this detailed guide on How to trade breakouts.

Trade Balance

The trade balance reflects the difference between a country’s exports and imports. A positive trade balance, where exports exceed imports, can strengthen a currency, as it indicates a strong economy. Conversely, a negative trade balance can weaken a currency.

How to Use an Economic Calendar Effectively

When it comes to utilizing an economic calendar for trading purposes, traders need to follow a strategic approach to make informed decisions based on economic data releases. Analyzing and interpreting this data correctly can significantly impact trading outcomes.

Analyzing Economic Data

- Pay attention to high-impact events: Focus on major economic indicators like GDP, interest rates, employment reports, and inflation data as they can significantly move the market.

- Compare actual data with forecasts: Look at how the actual data released compares to the market expectations. A positive deviation can lead to bullish market sentiment, while a negative deviation can trigger bearish movements.

- Understand the historical context: Analyze how the current data compares to past releases to identify trends and patterns that can help predict market reactions.

Interpreting and Reacting to Data Releases, Economic calendar for Forex traders

- Prepare for volatility: Be ready for increased market volatility around major economic releases and have risk management strategies in place to protect your positions.

- Wait for the initial reaction: Avoid entering trades immediately after the data release as the market can be erratic. Wait for the initial reaction to subside before making decisions.

- Use technical analysis: Combine economic data analysis with technical indicators to confirm trading signals and identify potential entry and exit points.

- Stay updated: Continuously monitor economic calendars for upcoming events and be prepared to adjust your trading strategy based on new information.

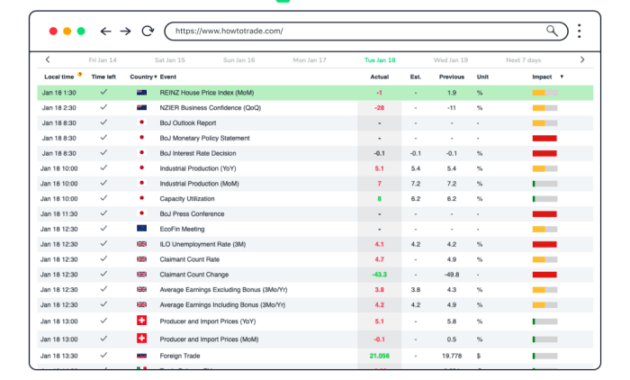

Features and Functionality of Economic Calendars: Economic Calendar For Forex Traders

When it comes to economic calendars for Forex traders, there are various features and functionalities that can help traders stay informed and make well-informed decisions. Let’s explore some of the key aspects of these calendars.

Comparison of Different Economic Calendars

- Forexfactory Economic Calendar: One of the most popular economic calendars in the Forex market, providing a comprehensive overview of global economic events and indicators.

- Bloomberg Economic Calendar: Offers a wide range of economic data, news, and analysis, catering to both beginner and advanced traders.

- Investing.com Economic Calendar: Known for its user-friendly interface and customizable features, allowing traders to filter events based on their preferences.

Customization Options and Tools

- Filtering: Most economic calendars allow users to filter events based on their impact, country, or specific time frame, helping traders focus on relevant information.

- Alerts: Traders can set up alerts for important economic events, ensuring they do not miss any market-moving announcements.

- Historical Data: Some calendars offer access to historical data, enabling traders to analyze past trends and patterns for better decision-making.

- Charts and Analysis: Many economic calendars provide charts and analysis tools to help traders visualize the impact of economic events on currency pairs.

Last Recap

In conclusion, the economic calendar serves as a vital tool for Forex traders, helping them navigate the complex world of currency markets with confidence. By staying informed and utilizing the right strategies, traders can react to data releases effectively and enhance their trading outcomes.