Fundamental analysis in Forex involves understanding the core factors that drive currency prices, offering traders valuable insights for informed decision-making. From economic indicators to geopolitical events, let’s delve into the essential aspects of this analytical approach.

Introduction to Fundamental Analysis in Forex

Fundamental analysis in forex trading involves analyzing various economic, social, and political factors that can affect the value of a currency. This type of analysis helps traders make informed decisions based on the underlying forces driving the market.

When it comes to trading news events, having the best strategies in place is crucial for success. By staying informed and analyzing market reactions, traders can capitalize on opportunities that arise. Utilizing tools such as economic calendars and risk management techniques can help navigate the volatile nature of news events.

For more insights on the best strategies for trading news events, check out this informative guide: Best strategies for trading news events.

Factors Influencing Currency Prices

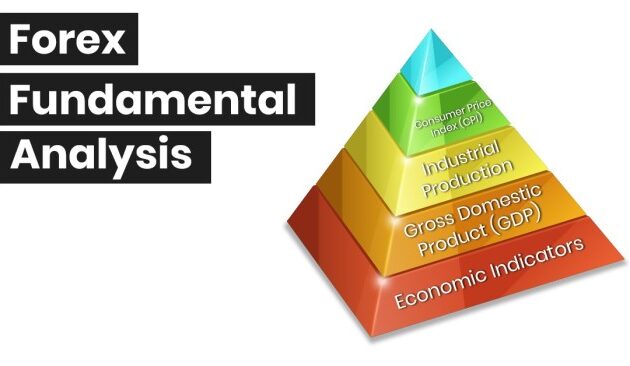

Several fundamental factors can influence currency prices in the forex market. Some examples include:

- Economic Indicators: Data such as GDP, employment rates, inflation, and retail sales can impact a country’s currency value.

- Central Bank Policies: Interest rate decisions and monetary policy statements from central banks can affect currency exchange rates.

- Political Stability: Political events, elections, and geopolitical tensions can lead to fluctuations in currency prices.

- Market Sentiment: Trader perceptions, risk appetite, and global economic trends can also influence currency movements.

Importance of Understanding Fundamental Analysis, Fundamental analysis in Forex

For forex traders, having a solid grasp of fundamental analysis is crucial for making informed trading decisions. By understanding the underlying factors driving currency movements, traders can anticipate market trends, manage risks, and identify potential trading opportunities.

When it comes to trading news events, it’s crucial to have the best strategies in place to maximize profits. By staying informed about market trends and economic indicators, traders can make well-informed decisions. One of the best strategies for trading news events is to use a combination of technical analysis and fundamental analysis to predict market movements.

This approach helps traders anticipate price fluctuations and capitalize on opportunities.

Economic Indicators in Fundamental Analysis

When it comes to fundamental analysis in Forex trading, economic indicators play a crucial role in providing insight into the health of a country’s economy. These indicators can help traders make informed decisions by understanding how economic factors influence currency valuation.

Key Economic Indicators Used in Fundamental Analysis

- Gross Domestic Product (GDP): GDP measures the total value of goods and services produced within a country’s borders. A strong GDP growth rate is generally positive for a currency, indicating a healthy economy.

- Unemployment Rate: The unemployment rate reflects the percentage of the workforce that is unemployed and actively seeking employment. High unemployment rates can weaken a currency, as it suggests economic instability.

- Inflation Rate: Inflation measures the rate at which the general level of prices for goods and services is rising. Central banks often use inflation targets to guide monetary policy, making it a critical indicator for Forex traders.

- Interest Rates: Central banks set interest rates to control inflation and economic growth. Higher interest rates can attract foreign investment, strengthening the currency.

Impact of Economic Indicators on Currency Valuation

Economic indicators can have a direct impact on currency valuation. Positive economic data typically leads to a stronger currency, as it signals a healthy economy. Conversely, negative economic indicators can weaken a currency, as they reflect economic challenges and uncertainty.

Interpreting Economic Data for Trading Decisions

Traders can use economic indicators to anticipate currency movements and make informed trading decisions. By analyzing economic data releases and understanding their implications on the market, traders can develop strategies to capitalize on potential opportunities. It’s essential to stay updated on key economic indicators and their potential impact on currency pairs to navigate the Forex market successfully.

Interest Rates and Central Bank Policies

Interest rates play a crucial role in fundamental analysis for forex trading as they directly impact the value of currencies. Central bank policies, particularly decisions related to interest rates, can significantly influence currency markets. Understanding how different central bank policies affect currency markets is essential for forex traders to make informed decisions.

Role of Interest Rates in Fundamental Analysis

Interest rates are one of the key factors that determine the value of a currency. Central banks use interest rates to control inflation, stimulate economic growth, and maintain financial stability. Higher interest rates attract foreign investment, leading to an appreciation of the currency. Conversely, lower interest rates can lead to a depreciation of the currency as investors seek higher returns elsewhere. Traders closely monitor central bank interest rate decisions and statements to anticipate changes in currency value.

Impact of Central Bank Policies on Currency Markets

Central bank policies, including interest rate decisions, can have a direct impact on currency markets. When a central bank raises interest rates, it signals confidence in the economy, attracting foreign investment and strengthening the currency. On the other hand, cutting interest rates can weaken the currency as investors seek higher returns elsewhere. Additionally, central bank policies such as quantitative easing or tightening can also affect currency markets by influencing liquidity and market sentiment.

Relationship between Interest Rates, Central Bank Decisions, and Currency Value

The relationship between interest rates, central bank decisions, and currency value is complex and multifaceted. Changes in interest rates can lead to shifts in capital flows, affecting exchange rates. Central bank decisions are closely watched by traders and investors, as they provide insights into the economic outlook and future monetary policy direction. Understanding the interplay between interest rates, central bank decisions, and currency value is essential for successful forex trading.

Geopolitical Events and Market Sentiment

Geopolitical events play a crucial role in shaping market sentiment in the forex world. These events can have a significant impact on currency valuations, as traders and investors react to the uncertainty and risks associated with political developments around the globe.

Market sentiment refers to the overall feeling or attitude of traders and investors towards a particular currency or market. It can be influenced by a variety of factors, including economic data releases, geopolitical events, and central bank policies. Positive market sentiment can lead to an increase in demand for a currency, driving up its value, while negative sentiment can have the opposite effect.

Role of Geopolitical Events

Geopolitical events such as elections, conflicts, trade disputes, and diplomatic tensions can create volatility in the forex markets. For example, the outcome of a presidential election in a major economy can cause uncertainty and lead to fluctuations in the value of the country’s currency. Similarly, trade tensions between two countries can impact their respective currencies as traders assess the potential economic consequences of the dispute.

Examples of Geopolitical Factors

- Trade Wars: The ongoing trade war between the US and China has had a significant impact on the value of the US dollar and the Chinese yuan. Tariffs and retaliatory measures can create uncertainty and lead to market volatility.

- Brexit: The prolonged Brexit negotiations between the UK and the European Union have caused fluctuations in the value of the British pound as traders react to the uncertainty surrounding the UK’s future relationship with its largest trading partner.

- Political Unrest: Political instability in a country can lead to currency depreciation as investors seek safer assets in times of uncertainty. For example, protests or government upheaval can cause a decline in the value of the affected country’s currency.

End of Discussion

In conclusion, mastering fundamental analysis in Forex is crucial for navigating the dynamic currency markets with confidence. By comprehending the key factors discussed, traders can enhance their trading strategies and achieve greater success in their financial endeavors.