With Best Forex indicators for analysis at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

Forex indicators play a crucial role in analyzing market trends and making informed trading decisions. Understanding the best indicators can significantly impact your success in the forex market.

Introduction to Forex Indicators

Forex indicators play a crucial role in analyzing the foreign exchange market and making informed trading decisions. These indicators are tools used by traders to identify potential trends, price movements, and entry/exit points in the market.

Are you looking to master the art of scalping in Forex trading? Understanding how to use scalping techniques effectively can help you maximize your profits in the fast-paced world of currency trading. Check out this comprehensive guide on How to use scalping in Forex and start implementing these strategies in your trading arsenal today.

Popular Forex Indicators, Best Forex indicators for analysis

- Moving Averages: This indicator helps to smooth out price data to identify trends over a specific period.

- Relative Strength Index (RSI): RSI measures the speed and change of price movements to determine overbought or oversold conditions.

- Bollinger Bands: These bands indicate price volatility and potential reversal points based on standard deviations from a moving average.

Importance of Using Indicators

By using Forex indicators, traders can gain valuable insights into market dynamics and make more informed decisions. These indicators help traders to avoid emotional trading and rely on objective data for their strategies.

When it comes to Forex trading, one strategy that traders often use is scalping. How to use scalping in Forex involves making small profits by entering and exiting trades quickly. This technique requires precision and quick decision-making skills. Scalping can be a high-risk, high-reward strategy, so it’s important to have a solid understanding of the market and a well-thought-out trading plan before diving in.

Types of Forex Indicators: Best Forex Indicators For Analysis

When it comes to analyzing the forex market, traders rely on a variety of indicators to make informed decisions. These indicators can be broadly categorized into different types based on their functions and characteristics.

Trend-following vs. Oscillating Indicators

Trend-following indicators are used to identify the direction of the market trend. They are most effective in trending markets and help traders spot potential entry and exit points. Oscillating indicators, on the other hand, are used to identify overbought or oversold conditions in the market. These indicators are more suitable for ranging or sideways markets.

Significance of Volume, Momentum, and Volatility Indicators

Volume indicators provide insights into the strength of a price movement by analyzing the trading volume. Momentum indicators measure the rate of price change, helping traders identify the speed at which prices are moving. Volatility indicators, on the other hand, measure the degree of variation in price movements, indicating the level of market uncertainty.

Leading and Lagging Indicators

Leading indicators are used to predict future price movements based on current market conditions. These indicators provide early signals of potential trend changes. Lagging indicators, on the other hand, confirm trends that have already begun, making them useful for confirming the strength of a trend.

Choosing the Best Forex Indicators

When it comes to selecting the best Forex indicators for analysis, traders need to consider several important criteria. These criteria can help in determining the most suitable indicators for a particular trading strategy and market conditions.

One of the key criteria for choosing the best Forex indicators is the accuracy and reliability of the indicator. Traders should look for indicators that have a proven track record of providing accurate signals and insights into market trends. Additionally, it is essential to consider the responsiveness of the indicator to changes in the market, as well as its ability to filter out noise and false signals.

Effectiveness of Different Indicators in Varying Market Conditions

- Volatility Indicators: These indicators are effective in volatile market conditions as they can help traders identify potential price movements and adjust their strategies accordingly.

- Trend Indicators: Trend indicators work well in trending markets, helping traders identify the direction of the trend and take advantage of trading opportunities.

- Momentum Indicators: Momentum indicators are useful in ranging markets, as they can signal potential changes in market direction and help traders anticipate trend reversals.

Combining Multiple Indicators for Comprehensive Analysis

- Traders can enhance their analysis by combining multiple indicators that complement each other. For example, using a combination of trend-following and momentum indicators can provide a more comprehensive view of market conditions.

- It is important to avoid using indicators that provide similar or redundant information, as this can lead to confusion and inaccurate analysis. Instead, traders should focus on using indicators that offer unique insights into different aspects of the market.

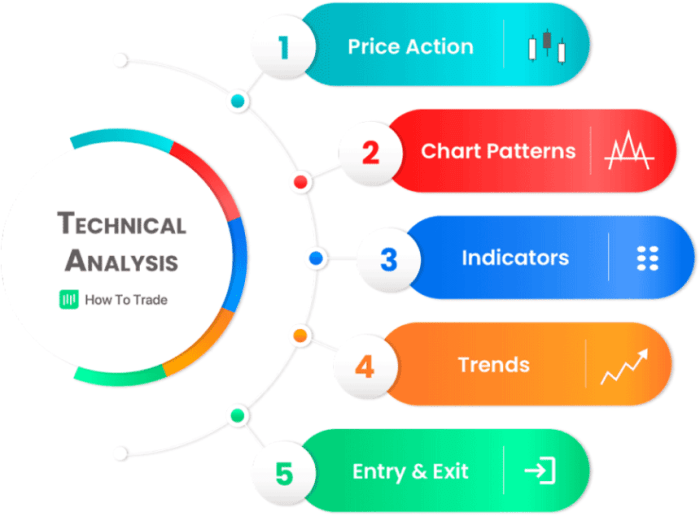

Technical Analysis with Forex Indicators

When it comes to technical analysis in forex trading, indicators play a crucial role in helping traders make informed decisions. These indicators are mathematical calculations based on historical price, volume, or interest rate data, providing insights into market trends and potential price movements.

Interpreting Signals Generated by Indicators

- One common way to interpret signals generated by indicators is through crossovers. This occurs when the indicator line crosses above or below another line, signaling a potential change in trend.

- Another method is to look for overbought or oversold conditions. Indicators like the Relative Strength Index (RSI) can help identify these extreme conditions, indicating a possible reversal in price.

- Additionally, traders can analyze divergence between price and indicator movements. Divergence suggests a weakening trend and a possible upcoming reversal.

Common Strategies for Applying Indicators in Technical Analysis

- One popular strategy is trend following, where traders use indicators like moving averages to identify and follow the direction of a trend.

- Contrarian traders, on the other hand, may use indicators to spot potential trend reversals and capitalize on market corrections.

- Some traders also combine multiple indicators to confirm signals and reduce the risk of false alarms.

Using Indicators to Identify Trends and Entry/Exit Points

- Indicators like the Moving Average Convergence Divergence (MACD) can help traders identify trends by showing the relationship between two moving averages.

- For entry points, traders may look for indicators like the Stochastic Oscillator to identify overbought or oversold conditions before entering a trade.

- Indicators can also be used to determine exit points, such as setting profit targets based on indicators like the Average True Range (ATR) to measure volatility.

Customizing and Developing Forex Indicators

When it comes to customizing and developing Forex indicators, traders have the opportunity to tailor their technical analysis tools to better suit their individual trading styles and strategies. This process involves modifying existing indicators or creating entirely new ones to provide more relevant and accurate signals.

Advantages and Challenges of Creating Personalized Indicators

Customizing indicators can offer several advantages, such as:

- Increased precision: Personalized indicators can be fine-tuned to specific market conditions, leading to more precise entry and exit points.

- Alignment with trading strategy: By developing indicators that reflect your unique approach to the market, you can enhance the effectiveness of your trading decisions.

- Improved risk management: Tailoring indicators to your risk tolerance and profit targets can help you manage risk more effectively.

However, there are also challenges associated with creating personalized indicators:

- Complexity: Developing custom indicators requires a strong understanding of technical analysis and programming skills, which can be challenging for novice traders.

- Testing and validation: It is essential to thoroughly backtest and validate custom indicators to ensure their reliability and effectiveness before using them in live trading.

- Time-consuming: Customizing indicators can be a time-consuming process that may require ongoing optimization and adjustment.

Resources and Tools for Developing New Forex Indicators

There are several resources and tools available to traders who want to develop new Forex indicators:

- Programming languages: Platforms like MetaTrader offer programming languages like MQL4 and MQL5 that allow traders to create custom indicators.

- Online communities: Forums and communities dedicated to Forex trading often provide valuable insights and support for traders looking to develop their own indicators.

- Educational resources: Books, online courses, and tutorials can help traders improve their technical analysis skills and learn how to develop effective indicators.

Last Recap

In conclusion, mastering the use of the best Forex indicators can elevate your trading game to new heights, providing you with valuable insights and tools for success in the dynamic world of forex trading.