Price action trading strategies take center stage, offering traders a unique approach to navigating the complexities of the financial markets. Dive into this guide to uncover the keys to success in the world of trading.

Explore the intricacies of price action, candlestick patterns, support and resistance levels, and trend analysis to elevate your trading game.

Introduction to Price Action Trading Strategies

Price action trading involves analyzing and making trading decisions based on the actual price movements of an asset, rather than relying on indicators or oscillators. Traders who use price action strategies focus on the historical prices and patterns to predict future price movements.

Importance of Price Action in Trading, Price action trading strategies

Price action is crucial in trading as it provides valuable insights into market sentiment and helps traders make informed decisions. By studying price movements, traders can identify key levels of support and resistance, trend reversals, and potential breakout opportunities.

- Price action helps traders understand the psychology behind market movements and make more accurate predictions.

- It allows traders to enter and exit trades at optimal levels, maximizing profits and minimizing losses.

- Price action strategies are versatile and can be applied to any financial market, including stocks, forex, and commodities.

Examples of Price Action Trading Strategies

There are several price action trading strategies that traders can implement, such as:

- Support and Resistance Levels: Identifying key levels where the price has historically reversed or stalled can help traders anticipate future price movements.

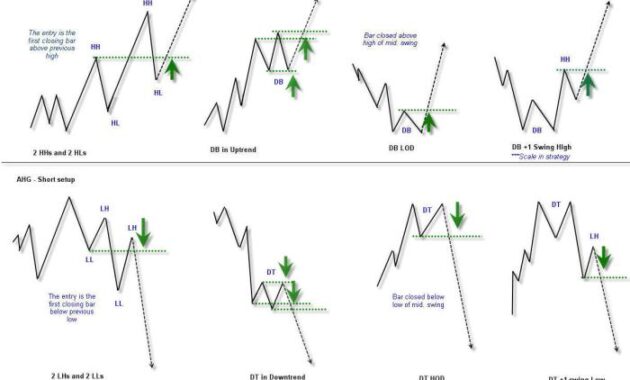

- Trend Following: Trading in the direction of the trend based on higher highs and higher lows (uptrend) or lower highs and lower lows (downtrend).

- Pin Bar Reversal: A candlestick pattern that indicates a potential trend reversal when the price rejects a certain level.

Benefits of Using Price Action Strategies in Trading

- Clear and Simple Analysis: Price action trading simplifies the decision-making process by focusing on the most relevant information – price movements.

- Adaptability: Price action strategies can be customized to suit individual trading styles and preferences.

- Effective Risk Management: By using price action to set stop-loss orders and profit targets, traders can effectively manage their risk exposure.

Candlestick Patterns in Price Action Trading

Candlestick patterns play a crucial role in price action trading, providing valuable insights into market sentiment and potential price movements. By understanding and interpreting these patterns, traders can make informed decisions to optimize their trading strategies.

One of the most common candlestick patterns used in price action trading is the Doji. A Doji consists of a small body with wicks on both ends, indicating indecision in the market. This pattern suggests a potential reversal or continuation depending on the context in which it appears.

Another popular candlestick pattern is the Hammer, characterized by a small body and a long lower wick. The Hammer signals a potential bullish reversal after a downtrend, as buyers step in to push the price higher.

On the other hand, the Shooting Star is a bearish reversal pattern with a small body and a long upper wick. This pattern indicates that sellers are starting to take control, potentially leading to a downward price movement.

It is essential to consider the significance of specific candlestick patterns in different market conditions. For example, a Bullish Engulfing pattern, where a large bullish candle completely engulfs the previous bearish candle, is more reliable in a strong uptrend compared to a ranging market.

Overall, mastering the interpretation of candlestick patterns can give traders a competitive edge in analyzing price movements and making effective trading decisions.

Support and Resistance Levels in Price Action Trading

Support and resistance levels are critical concepts in price action trading. Support refers to a price level where a downtrend can be expected to pause or reverse, while resistance is a price level where an uptrend may stall or reverse.

Traders use support and resistance levels in price action strategies to make trading decisions. These levels help traders identify potential entry and exit points, set stop-loss orders, and determine the overall market sentiment.

Identifying Strong Support and Resistance Levels

- Support and resistance levels can be identified by looking at historical price data on a chart.

- Strong support levels are often found at price points where the price has reversed multiple times in the past.

- Resistance levels are identified by price points where the price has struggled to break above in the past.

- Psychological price levels, round numbers, and moving averages can also act as support and resistance levels.

Examples of Price Bounces at Support and Resistance Levels

- When the price approaches a strong support level, traders may expect a bounce as buyers step in to push the price higher.

- Conversely, when the price nears a resistance level, sellers may enter the market, causing the price to reverse lower.

- Price bounces at support and resistance levels can provide trading opportunities for traders looking to capitalize on potential price reversals.

Trend Analysis in Price Action Trading

Trend analysis plays a crucial role in price action trading as it helps traders identify the direction in which an asset’s price is moving. By understanding the different types of trends and how to spot them using price action analysis, traders can make informed decisions about when to enter or exit trades.

Types of Trends

- Uptrend: An uptrend is characterized by higher highs and higher lows, indicating a bullish market sentiment.

- Downtrend: A downtrend is marked by lower highs and lower lows, signaling a bearish market sentiment.

- Sideways Trend: Also known as a ranging market, a sideways trend occurs when the price moves within a horizontal range without a clear upward or downward direction.

Identifying Trends

Traders can identify trends through price action analysis by looking at the overall direction of price movements and key support and resistance levels. Trendlines can also be drawn to visualize the trend direction more clearly.

Trend Reversal and Continuation Patterns

When a trend is likely to reverse, traders may observe patterns such as double tops or bottoms, head and shoulders, or engulfing patterns. These patterns indicate a potential change in market sentiment.

On the other hand, continuation patterns like flags, pennants, and triangles suggest that the current trend is likely to persist, providing trading opportunities for trend followers.

Ending Remarks: Price Action Trading Strategies

In conclusion, mastering price action trading strategies opens a world of endless possibilities for traders seeking success in the dynamic realm of financial markets. With dedication and practice, you can harness the power of price action to achieve your trading goals.

When it comes to trading in the foreign exchange market, one of the key factors to consider is EUR/USD volatility. Understanding the fluctuations in this currency pair can help traders make informed decisions and capitalize on potential opportunities. Whether you are a seasoned trader or just starting out, keeping an eye on the volatility of EUR/USD is crucial for success in the forex market.

When it comes to trading the financial markets, one of the most popular currency pairs to watch is the EUR/USD. The EUR/USD volatility is known for its rapid price movements and high trading volume, making it an attractive choice for both novice and experienced traders alike.

Understanding the factors that influence the volatility of this pair can help traders make more informed decisions and potentially increase their profits.