As Most volatile currency pairs to trade takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Currency trading can be a rollercoaster ride, especially when dealing with volatile pairs. In this guide, we’ll explore the most volatile currency pairs and how traders can navigate this high-risk, high-reward environment.

Most Volatile Currency Pairs to Trade

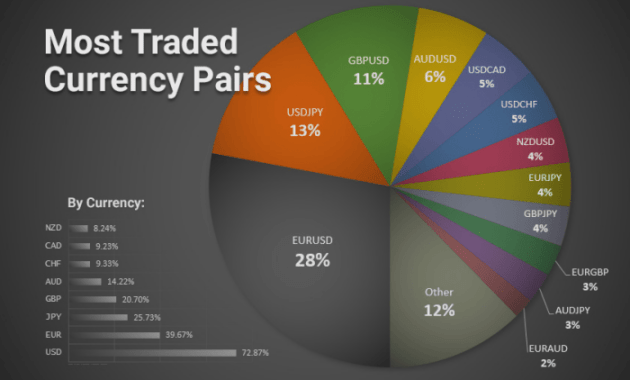

When it comes to forex trading, volatility is a key factor to consider. Volatility refers to the degree of variation in a trading price series over time. Some currency pairs are known for their high levels of volatility, making them attractive to traders seeking opportunities for profit.

When it comes to trading the foreign exchange market, one of the most popular currency pairs to analyze is the EUR/USD. Traders closely monitor the EUR/USD analysis to make informed decisions on their trades. Understanding the factors that influence the movement of this currency pair is crucial for success in forex trading.

For a detailed analysis of the EUR/USD pair, you can check out this insightful article on EUR/USD analysis.

List of Most Volatile Currency Pairs:

- EUR/USD

- GBP/JPY

- AUD/JPY

- USD/ZAR

- USD/TRY

Volatility is important for traders as it can offer greater opportunities for profit due to larger price movements within a short period. However, it also comes with increased risk, as higher volatility can lead to significant losses if not managed properly.

When it comes to forex trading, one of the most popular currency pairs to analyze is the EUR/USD. Traders around the world closely follow the movements of this pair to make informed decisions. If you’re interested in delving deeper into EUR/USD analysis , you’ll find a wealth of information and insights to help you navigate the market effectively.

Impact of Volatility on Trading Strategies and Risk Management:

High volatility can impact trading strategies in several ways. Traders may adjust their position sizes to account for increased volatility, implement wider stop-loss orders to avoid being stopped out too early, or choose to trade during specific times of the day when volatility is higher.

Effective risk management is crucial when trading volatile currency pairs. Traders should carefully consider their risk tolerance, set appropriate stop-loss levels, and diversify their trades to minimize the impact of unexpected price movements.

Factors Affecting Currency Pair Volatility

The volatility of currency pairs is influenced by various factors that can impact their price movements. Understanding these key factors is essential for traders looking to navigate the dynamic forex market.

Economic Indicators:

Economic indicators such as GDP growth, inflation rates, interest rates, and employment data play a significant role in determining the strength of a country’s economy. Positive economic data can lead to increased investor confidence, strengthening the currency and reducing volatility. On the other hand, negative economic indicators can trigger market uncertainty and volatility as traders react to the news.

Geopolitical Events:

Geopolitical events, such as elections, trade wars, and political instability, can have a profound impact on currency pair volatility. Sudden changes in government policies or diplomatic relations can create uncertainty in the market, leading to sharp fluctuations in currency prices. Traders often closely monitor geopolitical developments to anticipate potential market movements.

Market Sentiment:

Market sentiment, or the overall attitude of traders towards a particular currency pair, can also influence volatility. Positive sentiment can drive up demand for a currency, leading to price appreciation and lower volatility. Conversely, negative sentiment can result in a sell-off, causing increased volatility as traders adjust their positions.

Examples of Unexpected Events:

Unexpected events, such as natural disasters, terrorist attacks, or unexpected policy announcements, can have a sudden and significant impact on currency pair volatility. For instance, the Brexit referendum in the UK caused a sharp decline in the value of the British pound against other major currencies due to the uncertainty surrounding the country’s future relationship with the EU.

Strategies for Trading Volatile Currency Pairs

When it comes to trading highly volatile currency pairs, having a solid strategy in place is crucial. Traders need to be prepared to handle sudden price movements and fluctuations in order to capitalize on potential profit opportunities.

Setting Stop-Loss Orders and Profit Targets, Most volatile currency pairs to trade

One of the key strategies for trading volatile currency pairs is setting stop-loss orders and profit targets. Stop-loss orders help limit potential losses by automatically closing a trade if the price moves against you beyond a certain point. Profit targets, on the other hand, help lock in profits by closing a trade once a certain profit level is reached. By using these tools, traders can manage their risk effectively and protect their capital in volatile markets.

Adjusting Risk Management Techniques

In highly volatile markets, it’s important for traders to adjust their risk management techniques to account for increased volatility. This may involve reducing position sizes to limit exposure, using wider stop-loss orders to give trades more room to breathe, or even avoiding trading altogether during particularly turbulent times. By being flexible with risk management and adapting to market conditions, traders can navigate volatile currency pairs more effectively.

Tips for Managing Risks When Trading Volatile Currency Pairs

When trading the most volatile currency pairs, it is crucial to implement effective risk management strategies to protect your capital and maximize your potential for profits. By maintaining discipline, avoiding emotional decision-making, and utilizing diversification and proper position sizing, you can navigate the challenges of trading in volatile market conditions.

Importance of Discipline and Emotional Control

Maintaining discipline in your trading approach is essential when dealing with volatile currency pairs. Emotions such as fear and greed can cloud your judgment and lead to impulsive decisions that may result in significant losses. By sticking to your trading plan, remaining calm under pressure, and avoiding emotional reactions to market fluctuations, you can make more rational and informed choices.

Diversification and Position Sizing

Diversification involves spreading your risk across different assets or currency pairs to reduce the impact of any single trade on your overall portfolio. By diversifying your trades, you can protect yourself from excessive losses if one currency pair experiences a sudden and significant price movement. Additionally, proper position sizing ensures that you are not risking more capital than you can afford to lose on any single trade. By carefully managing the size of your positions relative to your account balance, you can limit potential losses and protect your trading capital.

Conclusive Thoughts

Navigating the world of volatile currency pairs requires a blend of strategy, risk management, and a disciplined mindset. By understanding the factors that drive volatility and implementing sound trading practices, traders can capitalize on market opportunities while minimizing potential risks.