Trade NZD/USD efficiently sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a brimming originality from the outset.

Understanding the basics of trading NZD/USD, identifying influencing factors, and discussing correlations with other major currencies are just the beginning of this insightful journey.

Understanding NZD/USD Trading

When it comes to trading the NZD/USD currency pair, it is essential to grasp the basics of this particular market. The NZD/USD pair represents the exchange rate between the New Zealand Dollar (NZD) and the US Dollar (USD). Traders often engage in this market to take advantage of the fluctuations in value between these two currencies.

Factors Influencing the NZD/USD Exchange Rate

The exchange rate of the NZD/USD pair is influenced by a variety of factors. These can include economic indicators such as GDP growth, employment data, inflation rates, and interest rates set by the respective central banks. Political stability, trade balances, and global events can also impact the exchange rate.

- Economic Indicators: Economic data releases can have a significant impact on the NZD/USD exchange rate. Positive economic data from New Zealand or the US can strengthen their respective currencies.

- Interest Rates: Central bank interest rate decisions can affect the value of the NZD and USD. Higher interest rates in New Zealand compared to the US can attract foreign investors, leading to a stronger NZD.

- Trade Balances: The trade balance between New Zealand and the US can affect the exchange rate. A trade surplus in New Zealand can lead to a stronger NZD.

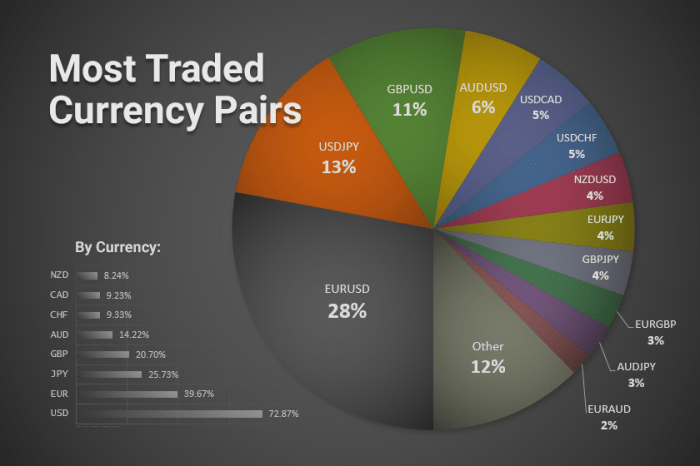

Correlation Between NZD, USD, and Other Major Currencies

The NZD/USD pair is also influenced by the correlation between the NZD, USD, and other major currencies such as the Euro (EUR), Japanese Yen (JPY), and Australian Dollar (AUD). Changes in these currencies can impact the NZD/USD exchange rate as traders often compare and analyze multiple currency pairs to make trading decisions.

It is important for traders to stay informed about the various factors that can influence the NZD/USD exchange rate in order to make informed trading decisions.

Strategies for Efficient NZD/USD Trading: Trade NZD/USD Efficiently

When trading the NZD/USD currency pair, it is crucial to have a solid strategy in place to maximize profits and minimize risks. Here are some common trading strategies and risk management techniques specific to NZD/USD trading:

Common Trading Strategies

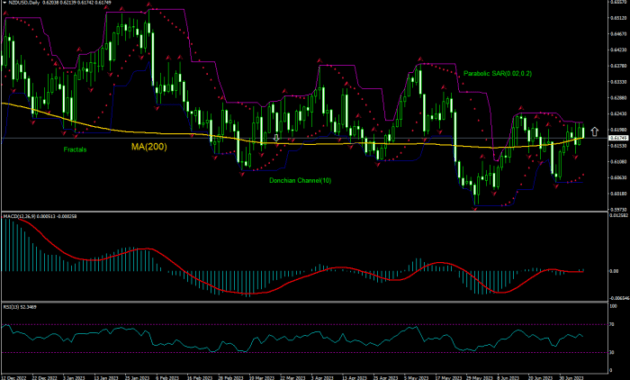

- Technical Analysis: Many traders rely on technical indicators such as moving averages, RSI, and MACD to identify trends and potential entry/exit points in the NZD/USD market.

- Breakout Trading: This strategy involves entering a trade when the price breaks above or below a key level of support or resistance, signaling a potential trend continuation.

- Carry Trade: Traders can take advantage of interest rate differentials between the New Zealand Dollar and US Dollar by holding a long position in NZD/USD to earn interest.

Risk Management Techniques

- Use Stop-Loss Orders: Setting stop-loss orders can help limit potential losses by automatically closing a trade at a predetermined price level.

- Position Sizing: Properly sizing your positions based on your risk tolerance and account size can help protect your capital in case of adverse price movements.

- Diversification: Avoid putting all your capital into a single trade by diversifying your portfolio across different currency pairs to reduce overall risk.

Short-Term vs. Long-Term Trading Approaches

- Short-Term Trading: Short-term traders focus on capitalizing on small price movements within a day or even hours. This approach requires quick decision-making and active monitoring of the market.

- Long-Term Trading: Long-term traders hold their positions for weeks, months, or even years, aiming to benefit from larger price trends. This approach requires patience and the ability to ride out market fluctuations.

Technical Analysis Tools for NZD/USD

When trading the NZD/USD currency pair, it is essential to utilize various technical analysis tools to make informed decisions and predictions. Key technical indicators, support and resistance levels, and moving averages play a crucial role in analyzing the NZD/USD pair and predicting price movements.

Key Technical Indicators

Technical indicators are mathematical calculations based on historical price, volume, or open interest data. They help traders identify trends, momentum, and potential reversal points in the market. Some key technical indicators commonly used in analyzing the NZD/USD pair include:

- Relative Strength Index (RSI): Measures the speed and change of price movements to determine overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): Shows the relationship between two moving averages of a security’s price to identify potential buy or sell signals.

- Bollinger Bands: Volatility bands placed above and below a moving average to help identify overbought or oversold conditions.

Support and Resistance Levels

Support and resistance levels are crucial in identifying potential entry and exit points in NZD/USD trading. Support levels act as a floor where the price tends to stop falling and bounce back up, while resistance levels act as a ceiling where the price tends to stop rising and pull back down. Traders can use these levels to set stop-loss orders, take-profit targets, and determine the overall trend of the market.

Moving Averages

Moving averages are trend-following indicators that smooth out price data to identify the direction of the trend. Traders often use moving averages to predict potential price movements in the NZD/USD pair. The two most common types of moving averages are:

- Simple Moving Average (SMA): Calculates the average price over a specific period to provide a clear picture of the trend.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to current price changes.

Traders often look for crossovers between different moving averages or use them as dynamic support and resistance levels to make trading decisions.

Fundamental Analysis for NZD/USD

Fundamental analysis plays a crucial role in understanding the forces that drive the movement of the NZD/USD currency pair. By focusing on economic indicators, geopolitical events, and interest rate decisions, traders can make more informed decisions when trading the NZD/USD pair.

Economic Indicators Impact on NZD/USD Trading

Economic indicators such as GDP growth, inflation rates, employment data, and trade balance numbers can significantly impact the value of the NZD/USD pair. Positive economic data from New Zealand may strengthen the NZD, while negative data could weaken it. Traders should closely monitor these indicators to gauge the health of the New Zealand economy and its potential impact on the currency pair.

Geopolitical Events and NZD/USD Exchange Rate, Trade NZD/USD efficiently

Geopolitical events like elections, trade agreements, and natural disasters can also influence the NZD/USD exchange rate. Political instability or uncertainty in either New Zealand or the United States can lead to volatility in the currency pair. Traders need to stay informed about geopolitical developments that could impact the NZD/USD exchange rate.

Interest Rate Decisions and NZD/USD Trading

Interest rate decisions by the Reserve Bank of New Zealand (RBNZ) and the Federal Reserve can have a significant impact on the NZD/USD pair. When a central bank raises interest rates, it can attract foreign investment and strengthen the local currency. Conversely, a rate cut can lead to a depreciation of the currency. Traders should pay close attention to central bank announcements and monetary policy decisions to anticipate potential movements in the NZD/USD exchange rate.

Ultimate Conclusion

In conclusion, mastering efficient trading strategies, technical analysis tools, and fundamental analysis for NZD/USD can lead to successful trading endeavors in the forex market. Dive into the world of NZD/USD trading with confidence and knowledge.

When it comes to trading, one of the most popular currency pairs to watch is the EUR/USD. The EUR/USD volatility is known for its rapid movements and fluctuations, making it a favorite among forex traders. Understanding the factors that influence this volatility can help traders make more informed decisions and better manage their risk.

Keep a close eye on economic indicators, geopolitical events, and market sentiment to stay ahead of the game in this dynamic market.

When it comes to trading, one of the key factors to consider is EUR/USD volatility. Understanding the fluctuations in this currency pair can help traders make informed decisions and maximize their profits. Keeping an eye on the volatility of EUR/USD can provide valuable insights into market trends and potential opportunities for trading.