Delving into How NFT tokens differ from cryptocurrencies, this introduction immerses readers in a unique and compelling narrative, with ahrefs author style that is both engaging and thought-provoking from the very first sentence.

This article explores the key disparities between NFT tokens and cryptocurrencies, shedding light on their distinct characteristics and functionalities.

Definition of NFT tokens and cryptocurrencies

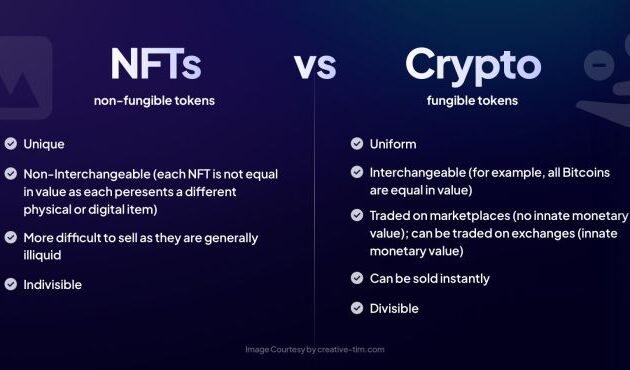

NFT tokens and cryptocurrencies are both digital assets, but they serve different purposes and have distinct characteristics. Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate independently of a central authority. On the other hand, NFT tokens are unique digital assets that represent ownership or proof of authenticity for a specific item or piece of content.

Fundamental Differences Between NFT Tokens and Cryptocurrencies

- NFT tokens are indivisible and unique, while cryptocurrencies are divisible and interchangeable.

- Cryptocurrencies are primarily used as a medium of exchange or store of value, whereas NFT tokens are used to represent ownership of digital or physical assets.

- NFT tokens are stored on blockchain platforms that support non-fungible tokens, while cryptocurrencies operate on their respective blockchain networks.

Unique Characteristics of NFT Tokens

NFT tokens have several unique characteristics that set them apart from cryptocurrencies:

- Each NFT token is distinct and cannot be replicated, making it unique and valuable.

- NFT tokens can represent ownership of digital art, collectibles, real estate, and other assets, adding a layer of authenticity and provenance.

- Ownership of an NFT token is recorded on the blockchain, providing a transparent and immutable record of ownership.

Examples of Popular NFT Tokens and Cryptocurrencies

- Popular NFT tokens include CryptoPunks, Axie Infinity, and NBA Top Shot, which represent unique digital assets in the form of art, virtual pets, and sports collectibles, respectively.

- Common cryptocurrencies like Bitcoin, Ethereum, and Binance Coin are widely used for transactions, investments, and decentralized applications within the blockchain ecosystem.

Technology behind NFT tokens and cryptocurrencies

The underlying technology that powers NFT tokens and cryptocurrencies is primarily blockchain technology. Blockchain is a decentralized and distributed ledger that records transactions across a network of computers. Each transaction is verified by a network of nodes, making it secure and transparent.

Utilization of Blockchain in NFT tokens and cryptocurrencies

Blockchain technology plays a crucial role in both NFT tokens and cryptocurrencies by providing a secure and immutable record of ownership and transactions. In the case of cryptocurrencies, blockchain ensures that every transaction is transparent and cannot be altered, preventing fraud and double-spending. For NFT tokens, blockchain serves as a digital ledger that authenticates the uniqueness and ownership of digital assets, such as art pieces, collectibles, and more.

Role of Smart Contracts in NFT tokens versus cryptocurrencies

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In the context of cryptocurrencies, smart contracts automate transactions and enforce the terms of the agreement without the need for intermediaries. This streamlines processes and reduces costs.

On the other hand, in the realm of NFT tokens, smart contracts play a vital role in defining ownership rights, royalties, and transferability of digital assets. These smart contracts ensure that the ownership and provenance of NFTs are transparent and verifiable, providing creators and buyers with a secure and efficient way to transact digital assets.

Use cases and applications

NFT tokens and cryptocurrencies have a wide range of use cases and applications across various industries, showcasing their versatility and potential impact on the digital ecosystem.

Use cases of NFT tokens

- NFT tokens are extensively used in the art industry, allowing artists to tokenize their work and sell it as unique digital assets. This has revolutionized the way art is bought and sold, providing artists with new revenue streams and ownership rights.

- In the gaming sector, NFT tokens are utilized to create in-game assets, characters, and skins that players can buy, sell, and trade. This enables gamers to truly own their digital belongings and even make profits by selling them in secondary markets.

- Real estate is another industry adopting NFT tokens for property ownership verification, fractional ownership, and tokenization of assets. This enhances liquidity, transparency, and accessibility in the real estate market.

Applications of cryptocurrencies beyond NFTs

- Cryptocurrencies like Bitcoin and Ethereum are widely used for peer-to-peer transactions, remittances, and cross-border payments, offering lower fees and faster processing times compared to traditional banking systems.

- Smart contracts powered by cryptocurrencies enable decentralized finance (DeFi) applications such as lending, borrowing, and trading without intermediaries. This opens up financial services to individuals who are underserved by traditional institutions.

- Cryptocurrencies are also utilized for fundraising through Initial Coin Offerings (ICOs) and Security Token Offerings (STOs), allowing startups to raise capital globally by issuing digital tokens to investors.

Comparison of NFT tokens and cryptocurrencies in the digital ecosystem, How NFT tokens differ from cryptocurrencies

- NFT tokens focus on tokenizing unique assets like digital art, collectibles, and real estate, emphasizing ownership and provenance. On the other hand, cryptocurrencies serve as digital currencies for transactions and store of value, with a broader range of use cases beyond asset tokenization.

- While NFT tokens are indivisible and represent ownership of a specific asset, cryptocurrencies like Bitcoin are divisible and fungible, allowing for easier exchange and use as a medium of exchange.

- Both NFT tokens and cryptocurrencies leverage blockchain technology for secure and transparent transactions, but they cater to different needs and purposes within the digital ecosystem, showcasing the diversity and innovation in the blockchain space.

Value and ownership: How NFT Tokens Differ From Cryptocurrencies

When it comes to NFT tokens and cryptocurrencies, the concept of value and ownership plays a crucial role in determining the worth of these digital assets. Let’s delve deeper into how ownership is established and transferred in NFT tokens, the valuation mechanisms for NFT tokens versus cryptocurrencies, and how value is perceived in this context.

Ownership in NFT tokens

Ownership in NFT tokens is established through the use of blockchain technology, which provides a decentralized and immutable ledger to record the ownership of a specific digital asset. Each NFT token is unique and is represented by a digital certificate of ownership that is stored on the blockchain. When an NFT token is transferred from one individual to another, the ownership record is updated on the blockchain, ensuring transparency and security in the ownership transfer process.

Valuation mechanisms for NFT tokens versus cryptocurrencies

The valuation of NFT tokens differs from cryptocurrencies due to their unique characteristics. NFT tokens derive their value from factors such as scarcity, uniqueness, and demand from collectors or enthusiasts. The value of an NFT token is often subjective and can vary greatly based on the perceived worth of the digital asset in the eyes of potential buyers. On the other hand, cryptocurrencies like Bitcoin or Ethereum are valued based on factors such as market demand, supply, utility, and adoption within the crypto ecosystem.

Perception of value in NFT tokens and cryptocurrencies

The perception of value in NFT tokens and cryptocurrencies is influenced by various factors such as market trends, cultural significance, historical context, and the overall sentiment of investors and collectors. While cryptocurrencies are often seen as digital currencies or store of value assets, NFT tokens are more focused on representing ownership of digital art, collectibles, or other unique assets. The value of NFT tokens and cryptocurrencies can fluctuate rapidly based on market dynamics and external factors, making them inherently volatile but also potentially lucrative investment opportunities.

Final Wrap-Up

In conclusion, the differences between NFT tokens and cryptocurrencies are vast and significant, highlighting the diverse ways these digital assets are utilized in the modern landscape. As the market continues to evolve, understanding these distinctions is crucial for investors and enthusiasts alike.

When it comes to trading, it’s important to consider alternatives to Tether. One option worth exploring is Tether alternatives for trading which offers stability and security for your transactions. By diversifying your portfolio with these alternatives, you can mitigate risks and potentially increase your returns in the volatile market.

When it comes to trading, having alternatives to Tether can be crucial. Tether alternatives for trading offer different benefits and risks that traders need to consider. Some popular alternatives include Tether alternatives for trading that provide stability and security. Understanding these options can help traders navigate the volatile market more effectively.