Download Genshin Impact PC adalah langkah awal menuju petualangan epik di dunia Teyvat. Game ini telah mencuri hati banyak gamer dengan grafis menawan, cerita mendalam, dan gameplay yang menarik. Selain itu, berbagai fitur seperti karakter yang dapat diubah, elemen elemen yang berbeda, dan kolaborasi dengan pemain lain membuat Genshin Impact menjadi salah satu permainan terpopuler saat ini.

Dengan dukungan di berbagai platform termasuk PC, Genshin Impact menawarkan pengalaman bermain yang lebih kaya. Proses pengunduhan dan instalasi yang sederhana memungkinkan siapa saja untuk segera terjun ke dalam dunia fantasi yang penuh warna ini. Jadi, siap untuk menjelajahi setiap sudut Teyvat dan menemukan keajaiban yang menanti?

Pengenalan Genshin Impact

Genshin Impact adalah game aksi RPG yang dikembangkan oleh miHoYo dan telah mencuri perhatian banyak gamer di seluruh dunia. Dengan grafis yang memukau dan gameplay yang menarik, Genshin Impact menawarkan pengalaman bermain yang menyenangkan di dunia terbuka yang luas. Setiap pemain akan diajak untuk menjelajahi berbagai wilayah, menyelesaikan quest, dan bertemu dengan berbagai karakter unik yang memiliki kemampuan dan cerita masing-masing.

Fitur utama yang membuat Genshin Impact sangat populer adalah mekanisme bermain yang intuitif dan mendalam. Pemain dapat mengendalikan beberapa karakter dalam satu tim, masing-masing dengan elemen dan kemampuan yang berbeda. Ini menambah kedalaman strategi dalam pertempuran. Selain itu, permainan ini juga memiliki sistem gacha yang memungkinkan pemain untuk mendapatkan karakter dan senjata baru, sehingga memberikan insentif untuk terus bermain dan mengumpulkan berbagai item.

Platform Pendukung Genshin Impact

Genshin Impact tersedia di berbagai platform, memberikan kemudahan bagi para pemain untuk mengaksesnya. Berikut adalah rincian platform yang mendukung Genshin Impact:

- PC: Game ini dapat diunduh dan dimainkan di komputer dengan spesifikasi yang memadai, menawarkan pengalaman grafis yang lebih baik dibandingkan platform lainnya.

- PlayStation: Genshin Impact juga tersedia untuk konsol PlayStation 4 dan PlayStation 5, memungkinkan pemain menikmati permainan di layar besar.

- Mobile: Untuk pengguna smartphone, game ini dapat diunduh di perangkat iOS dan Android, sehingga dapat dimainkan kapan saja dan di mana saja.

- Cross-Platform: Salah satu fitur menarik adalah kemampuan untuk bermain secara cross-platform, yang memungkinkan pemain dari berbagai platform untuk berinteraksi dan bermain bersama.

Daya tarik Genshin Impact tidak hanya terletak pada gameplay dan grafisnya, tetapi juga pada komunitas yang aktif dan konten yang terus diperbarui. Dengan update rutin dan berbagai event dalam game, pemain selalu memiliki alasan untuk kembali dan menjelajahi dunia Teyvat yang penuh misteri.

Proses Download Genshin Impact untuk PC

Mengunduh Genshin Impact di PC cukup mudah dan tidak memerlukan banyak waktu. Dalam artikel ini, kita akan membahas langkah-langkah yang diperlukan untuk mengunduh game ini dan memastikan perangkat Anda memenuhi spesifikasi yang dibutuhkan agar bisa menikmati pengalaman bermain yang optimal.

Langkah-langkah Mengunduh Genshin Impact di PC

Untuk memulai, berikut adalah langkah-langkah yang harus Anda ikuti untuk mengunduh Genshin Impact di PC:

- Kunjungi situs resmi Genshin Impact di genshin.mihoyo.com.

- Pilih opsi “Download” yang biasanya terletak di menu utama.

- Pilih versi untuk PC dan klik tombol unduh versi Windows.

- Setelah file installer terunduh, buka file tersebut untuk memulai proses instalasi.

- Ikuti instruksi yang muncul di layar untuk menyelesaikan instalasi.

- Setelah instalasi selesai, buka Genshin Impact dan buat akun atau masukkan akun yang sudah ada untuk memulai permainan.

Spesifikasi Minimum dan Rekomendasi untuk PC

Agar Genshin Impact dapat berjalan dengan baik di PC Anda, penting untuk memastikan bahwa perangkat memenuhi spesifikasi yang diperlukan. Berikut adalah tabel yang merinci spesifikasi minimum dan rekomendasi:

| Spesifikasi | Minimum | Rekomendasi |

|---|---|---|

| OS | Windows 7 SP1, Windows 8.1, Windows 10 | Windows 10 |

| Prosesor | Intel Core i5 atau setara | Intel Core i7 atau setara |

| RAM | 8 GB | 16 GB |

| Kartu Grafis | NVIDIA GeForce GT 1030 atau setara | NVIDIA GeForce GTX 1060 6 GB atau setara |

| DirectX | Versi 11 | Versi 11 |

| Ruang Penyimpanan | 30 GB | 30 GB |

Metode Alternatif untuk Mengunduh Genshin Impact

Selain mengunduh langsung dari situs resminya, terdapat beberapa metode alternatif yang bisa Anda gunakan untuk mendapatkan Genshin Impact. Berikut ini adalah beberapa di antaranya:

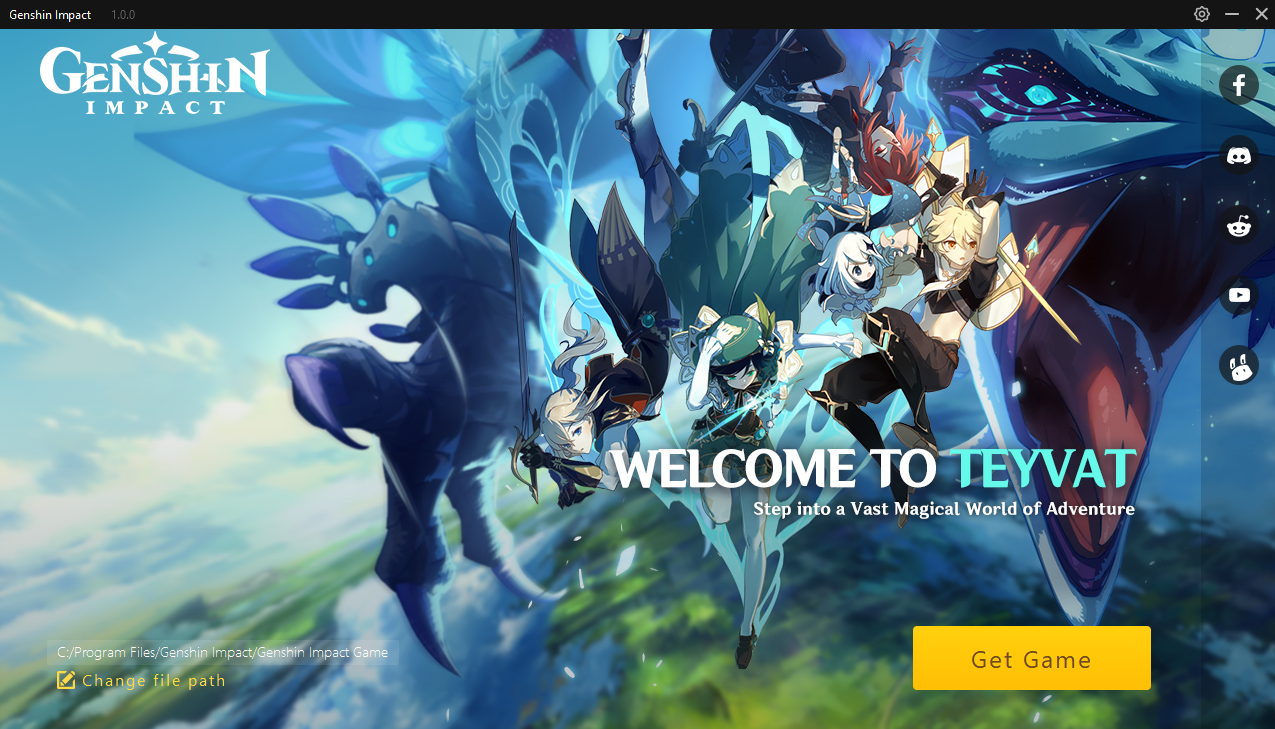

- Launcher MiHoYo: Anda dapat mengunduh Genshin Impact melalui launcher resmi MiHoYo. Cukup unduh launcher, dan setelah terinstal, Anda dapat mengelola pengunduhan game dari dalam aplikasi.

- Platform Game: Genshin Impact juga tersedia di platform seperti Epic Games Store. Jika Anda sudah memiliki akun di sana, Anda bisa langsung mencarinya dan mengunduhnya dari situ.

- File Installer dari Sumber Terpercaya: Anda bisa mencari file installer di situs-situs terpercaya, tetapi pastikan untuk selalu memeriksa keaslian file untuk menghindari malware.

“Pastikan untuk selalu mengunduh game dari sumber resmi untuk menjaga keamanan perangkat Anda.”

Instalasi dan Setup Genshin Impact di PC

Setelah berhasil mengunduh Genshin Impact, langkah selanjutnya adalah melakukan instalasi dan pengaturan awal agar permainan dapat berjalan dengan lancar. Berikut adalah panduan yang akan membantu kamu dalam proses ini.

Proses Instalasi Genshin Impact

Untuk menginstal Genshin Impact setelah diunduh, kamu perlu mengikuti beberapa langkah sederhana. Berikut adalah langkah-langkahnya:

- Buka file instalasi yang telah diunduh dan jalankan.

- Pilih lokasi instalasi yang diinginkan pada PC kamu. Pastikan memiliki ruang yang cukup untuk menghindari masalah di kemudian hari.

- Klik tombol ‘Install’ dan tunggu proses instalasi selesai. Ini mungkin memakan waktu beberapa menit tergantung pada kecepatan sistem kamu.

- Setelah instalasi selesai, buka Genshin Impact dari shortcut di desktop atau melalui folder instalasi.

Pengaturan Awal Dalam Game

Setelah Genshin Impact terinstal, penting untuk melakukan pengaturan awal sebelum memulai permainan. Langkah-langkah ini akan membantu meningkatkan pengalaman bermain kamu:

- Sesuaikan pengaturan grafis sesuai dengan kemampuan PC untuk mendapatkan performa yang optimal.

- Atur kontrol yang nyaman, terutama jika kamu menggunakan keyboard dan mouse.

- Periksa pengaturan suara untuk memastikan kualitas audio yang baik selama bermain.

- Aktifkan atau nonaktifkan fitur-fitur tertentu sesuai preferensi pribadi, seperti efek suara atau subtitel.

Mengatasi Masalah Umum Saat Instalasi, Download genshin impact pc

Meskipun proses instalasi seharusnya berjalan lancar, terkadang ada masalah yang mungkin muncul. Berikut adalah solusi untuk beberapa masalah umum yang mungkin kamu hadapi:

- Jika proses instalasi terhenti, coba jalankan sebagai administrator dengan mengklik kanan pada file instalasi dan memilih opsi ‘Run as administrator’.

- Pastikan antivirus atau firewall tidak memblokir proses instalasi. Jika perlu, matikan sementara atau tambahkan pengecualian untuk Genshin Impact.

- Jika mengalami kesulitan dengan koneksi internet, coba restart router atau gunakan koneksi yang lebih stabil.

- Jika menghadapi kesalahan saat membuka game, pastikan semua driver perangkat keras, terutama kartu grafis, telah diperbarui ke versi terbaru.

Memaksimalkan Pengalaman Bermain di PC: Download Genshin Impact Pc

Untuk para Traveler yang ingin merasakan pengalaman bermain Genshin Impact di PC secara maksimal, ada beberapa pengaturan dan strategi yang bisa kamu terapkan. Dengan beberapa penyesuaian yang tepat, kamu bisa menikmati grafis yang lebih tajam dan gameplay yang lebih responsif. Berikut adalah beberapa tips yang bisa kamu coba untuk meningkatkan pengalaman bermainmu.

Pengaturan Grafis dan Kontrol

Mengoptimalkan pengaturan grafis sangat penting untuk mendapatkan pengalaman bermain yang lebih baik. Berikut adalah beberapa opsi yang perlu kamu pertimbangkan:

- Resolusi Layar: Pastikan untuk menyesuaikan resolusi layar sesuai dengan kemampuan monitor kamu, semakin tinggi resolusinya, semakin jelas tampilan grafis yang dihasilkan.

- Grafis Detail: Sesuaikan tingkat detail grafis seperti tekstur, bayangan, dan efek khusus. Turunkan pengaturan ini jika PC mu terasa lag saat bermain.

- Frame Rate: Mengatur frame rate ke 60 FPS bisa memberikan pengalaman bermain yang lebih mulus. Pastikan PC kamu mampu mendukungnya.

- V-Sync: Mengaktifkan V-Sync dapat membantu mengatasi tearing screen, meskipun ini mungkin sedikit mengurangi frame rate.

Tips dan Trik Memaksimalkan Performa

Untuk memastikan performa Genshin Impact di PC tetap optimal, berikut adalah beberapa tips tambahan:

- Perbarui Driver Grafis: Selalu perbarui driver GPU ke versi terbaru untuk memastikan dukungan optimal terhadap game terbaru.

- Penutupan Aplikasi Latar Belakang: Tutup aplikasi lain yang tidak diperlukan untuk mengurangi penggunaan RAM dan CPU saat bermain.

- Monitor Suhu: Perhatikan suhu PC kamu. Menggunakan software pemantauan suhu dapat membantu mencegah overheating yang dapat memperlambat kinerja.

- Pengaturan Mode Daya: Pastikan mode daya PC kamu diatur ke ‘High Performance’ untuk memaksimalkan kinerja saat bermain game.

Rekomendasi Komunitas Pemain

Banyak pemain Genshin Impact yang berbagi pengalaman dan tips mereka dalam komunitas. Salah satu yang sering muncul adalah pentingnya penyesuaian kontrol. Beberapa rekomendasi yang sering dibagikan adalah:

“Gunakan kombinasi keyboard yang nyaman dan sesuaikan sensitivitas mouse untuk mendapatkan kontrol yang lebih responsif saat bertarung.” – Komunitas Genshin Impact

Dengan mengikuti tips dan rekomendasi ini, kamu bisa merasakan peningkatan signifikan dalam pengalaman bermain Genshin Impact di PC. Pastikan untuk bereksperimen dengan pengaturan yang berbeda dan temukan kombinasi yang paling cocok untuk gaya bermainmu. Selamat bermain!

Pembaruan dan Konten Baru Genshin Impact

Genshin Impact terus berkembang dengan berbagai pembaruan yang menarik, memberikan pengalaman bermain yang semakin seru. Pembaruan ini tidak hanya mencakup perbaikan bug, tetapi juga penambahan konten baru yang menambah kedalaman dalam gameplay. Mari kita lihat bagaimana cara memperbarui game ini di PC, konten baru yang ditambahkan, dan cara tetap up-to-date dengan berita terbaru.

Cara Memperbarui Genshin Impact di PC

Memperbarui Genshin Impact di PC adalah proses yang cukup sederhana. Berikut langkah-langkahnya:

- Buka launcher Genshin Impact di PC Anda.

- Jika ada pembaruan yang tersedia, biasanya launcher akan menampilkan notifikasi di halaman utama.

- Klik tombol ‘Update’ untuk memulai proses pembaruan. Pastikan koneksi internet Anda stabil agar pembaruan berjalan lancar.

- Tunggu hingga proses selesai, dan kemudian Anda dapat langsung memulai permainan dengan konten terbaru yang tersedia.

Konten Baru dalam Pembaruan Genshin Impact

Setiap pembaruan Genshin Impact biasanya menghadirkan sejumlah konten baru. Ini bisa mencakup karakter baru, area eksplorasi, misi, hingga senjata dan artefak. Berikut adalah beberapa jenis konten yang sering ditambahkan:

- Karakter Baru: Pembaruan sering kali memperkenalkan karakter baru dengan kemampuan unik yang dapat mengubah strategi bermain.

- Area Baru: Penambahan lokasi baru untuk dieksplorasi memberikan kesempatan bagi pemain untuk menemukan lebih banyak rahasia dan tantangan.

- Misi dan Event: Misi baru dan event terbatas sering kali memberikan hadiah menarik dan kesempatan untuk mendapatkan karakter atau item eksklusif.

- Perbaikan dan Penyeimbangan: Pembaruan juga menyertakan perbaikan bug dan penyesuaian keseimbangan untuk meningkatkan pengalaman bermain.

Mengetahui Berita dan Informasi Terbaru tentang Genshin Impact

Untuk tetap terhubung dengan berita dan informasi terbaru mengenai Genshin Impact, ada beberapa cara yang bisa dilakukan. Pemain dapat mengikuti akun resmi Genshin Impact di media sosial seperti Twitter, Facebook, dan Instagram. Selain itu, situs web resmi dan forum komunitas juga merupakan sumber informasi yang baik. Bergabung dalam grup Discord atau forum Reddit dapat membantu Anda berdiskusi dengan pemain lain dan mendapatkan informasi terbaru dengan cepat. Dengan cara ini, Anda tidak akan ketinggalan berita penting dan dapat memaksimalkan pengalaman bermain Anda.

Kalau kamu lagi nyari seru-seruan, coba deh main mini games online. Permainan-permainan kecil ini bukan cuma menghibur, tapi juga bisa jadi cara asyik buat mengisi waktu luang. Dengan berbagai genre dan kemudahan aksesnya, kamu bisa main di mana saja dan kapan saja. Ajak teman-teman untuk bersaing dan nikmati keseruan yang ditawarkan!

Kalau kamu lagi nyari cara seru buat mengisi waktu luang, coba deh eksplorasi mini games online. Permainan-permainan ini bukan hanya menghibur, tapi juga bisa jadi cara yang asyik buat bersantai bareng teman. Dengan berbagai pilihan yang menarik, kamu pasti akan menemukan game yang pas dengan selera kamu!