How to earn interest with USDT takes center stage in the world of cryptocurrencies, offering a unique opportunity to grow your assets. Discover the ins and outs of earning interest with USDT and how it can benefit your financial portfolio.

Overview of USDT

USDT, or Tether, is a type of cryptocurrency known as a stablecoin, designed to maintain a stable value by pegging it to a reserve of fiat currencies like the US dollar. This distinguishes USDT from other cryptocurrencies like Bitcoin or Ethereum, which are known for their price volatility.

Stability of USDT

Unlike other volatile cryptocurrencies, USDT’s value is intended to remain relatively steady, making it a popular choice for investors looking to avoid the price fluctuations associated with traditional cryptocurrencies. This stability is achieved through Tether’s reserves and transparency policies.

Purpose of USDT in the Crypto Market, How to earn interest with USDT

USDT serves as a bridge between fiat currencies and cryptocurrencies, providing a stable value that can be easily exchanged for other digital assets. It is commonly used for trading, storing value, and transferring funds across different cryptocurrency exchanges without the need to convert back to fiat currencies.

When comparing Bitcoin and Ethereum, it’s essential to understand the key differences between the two leading cryptocurrencies. While Bitcoin is known for being the first decentralized digital currency, Ethereum offers smart contract functionality and a platform for decentralized applications. To delve deeper into the Bitcoin vs Ethereum comparison, check out this comprehensive guide Bitcoin vs Ethereum comparison for a detailed analysis of their features, use cases, and future potential.

Understanding Interest Earning with USDT

Earning interest with USDT involves leveraging the stablecoin’s value to generate passive income over time. This process typically involves depositing USDT into specific platforms or services that offer interest-bearing accounts or products.

Platforms Offering Interest on USDT

- BlockFi: BlockFi is a popular platform that allows users to earn interest on USDT deposits. Users can earn interest rates that vary based on market conditions.

- Celsius Network: Celsius Network offers interest on USDT deposits, providing users with the opportunity to earn passive income on their holdings.

- Nexo: Nexo is another platform that enables users to earn interest on USDT deposits, with interest rates that are paid out daily.

Benefits of Earning Interest with USDT

- Higher Returns: Earning interest on USDT can often provide higher returns compared to traditional savings accounts, allowing users to grow their wealth more effectively.

- Flexibility: Platforms that offer interest on USDT usually provide flexible withdrawal options, allowing users to access their funds when needed without penalties.

- Diversification: By earning interest on USDT, users can diversify their investment portfolio and explore additional income streams beyond traditional assets.

Platforms for Earning Interest

There are several platforms and services that allow users to earn interest on USDT, providing an opportunity to grow their holdings passively. Let’s explore some of the popular options available.

Binance Earn

Binance Earn is a platform offered by Binance that allows users to stake their USDT and earn interest over time. The platform offers flexible and locked savings options, with varying interest rates depending on the chosen product.

- Flexible Savings: Users can deposit and withdraw their USDT at any time, with interest rates typically ranging from 3% to 10% annually.

- Locked Savings: Users can commit their USDT for a specific period, such as 30 days or 90 days, to earn higher interest rates, usually between 5% to 15% annually.

Celsius Network

Celsius Network is another popular platform that allows users to earn interest on their USDT deposits. The platform offers competitive interest rates, often higher than traditional banks.

When comparing Bitcoin vs Ethereum, it’s essential to understand the differences between the two leading cryptocurrencies. Bitcoin is known for its store of value and limited supply, while Ethereum is a platform for smart contracts and decentralized applications. If you’re looking to invest or use cryptocurrencies, it’s crucial to consider their unique features and potential for growth.

For a detailed comparison between Bitcoin and Ethereum, you can check out this Bitcoin vs Ethereum comparison article.

- Users can earn interest on their USDT deposits, with rates varying based on market conditions.

- Interest is paid out weekly, providing users with a consistent stream of passive income.

Nexo

Nexo is a crypto lending platform that also allows users to earn interest on their USDT holdings. Users can deposit their USDT into their Nexo account to start earning interest immediately.

- Nexo offers daily interest payouts on USDT deposits, providing users with a steady income stream.

- Interest rates on Nexo can vary based on market conditions but are typically competitive compared to traditional financial products.

Risks and Considerations

When it comes to earning interest on USDT, there are certain risks and considerations that you need to be aware of in order to make informed decisions.

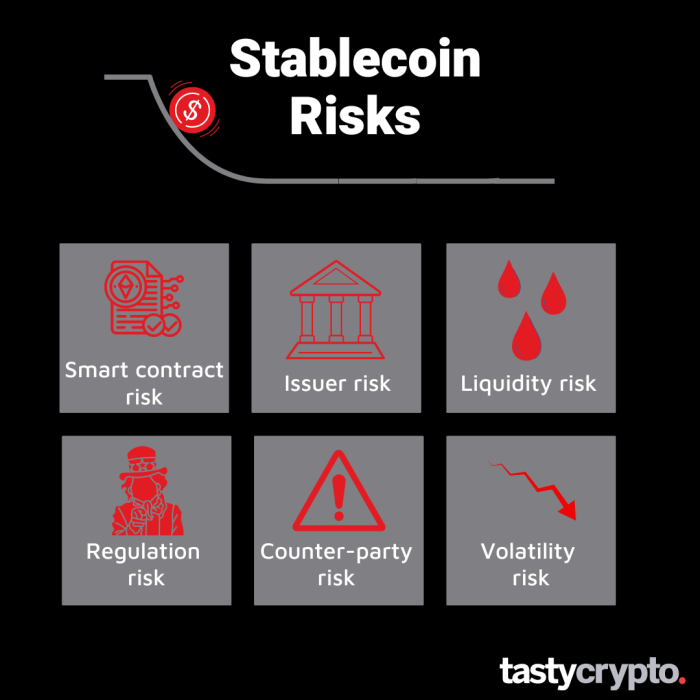

Risks Associated with Earning Interest on USDT

- Counterparty Risk: There is a risk that the platform or institution offering interest on USDT may default or become insolvent, leading to potential loss of funds.

- Market Risk: The value of USDT can fluctuate due to market conditions, impacting the overall return on your investment.

- Regulatory Risk: Regulatory changes or interventions in the cryptocurrency space can affect the viability of platforms offering interest on USDT.

- Liquidity Risk: There may be limitations on accessing your funds promptly, especially in times of high demand or market stress.

Factors Affecting Interest Rates on USDT

- Market Demand: Higher demand for borrowing USDT can lead to increased interest rates for lenders.

- Platform Risk: The risk profile of the platform offering interest can influence the rates they provide to users.

- Market Conditions: Overall market conditions, such as interest rates and economic factors, can impact the rates offered on USDT.

Tips to Mitigate Risks when Earning Interest with USDT

- Diversify: Spread your USDT investments across multiple platforms to reduce concentration risk.

- Research: Conduct thorough due diligence on platforms before investing to assess their credibility and security measures.

- Stay Informed: Keep up to date with regulatory developments and market trends that may impact your USDT investments.

- Use Stop-Loss Orders: Consider setting stop-loss orders to limit potential losses in case of significant market fluctuations.

Outcome Summary: How To Earn Interest With USDT

In conclusion, delving into the realm of earning interest with USDT opens up new avenues for financial growth and stability in the ever-evolving crypto market. Start maximizing your earnings today with these valuable insights.